Consumer credit outstanding growth slowed to 2.5% in July, down from 3.4% in July (SAAR) according to the Federal Reserve’s latest G.19 Consumer Credit report. Revolving credit growth reaccelerated to 9.2% in July, potentially reflecting strong consumer sentiment and job security in a tight—albeit cooling—labor market. In contrast, nonrevolving consumer debt outstanding inched up just 0.2% over the month.

Total revolving consumer credit has surged 10.8% over the past 12 months, more than offsetting slow growth in nonrevolving credit outstanding. Total consumer credit outstanding stands at $5.0 trillion (break-adjusted[1] and seasonally adjusted), with $1.3 trillion in revolving debt and $3.7 trillion in non-revolving debt.

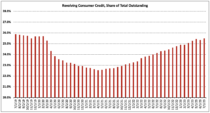

Seasonally adjusted revolving and nonrevolving debt accounted for 25.5% and 74.5% of total consumer debt, respectively.

Revolving consumer credit outstanding as a share of the total increased 0.2 percentage point over the quarter and is 0.5 percentage point higher than it was one year ago.

[1] The results of the 2020 Census and Survey of Finance Companies–delayed by the pandemic–were incorporated in the latest Consumer Credit (G.19) statistical release, resulting in large revisions dating back to June 2021. Rather than retain the large spike in credit that now appears in the raw data, we have used the “break-adjusted” historical time series developed by Moody’s Analytics and will continue to do so moving forward. Click here for more information.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.

The reacceleration of revolving credit growth in July may have implications for construction loans. Builders/clients should monitor credit market trends closely, as they can affect interest rates and loan availability. Being informed about these fluctuations is essential for securing the most advantageous financing terms for construction projects. That is why it’s important to have the right financial partner by your side that can make all the difference. Check out BuilderLoans.net