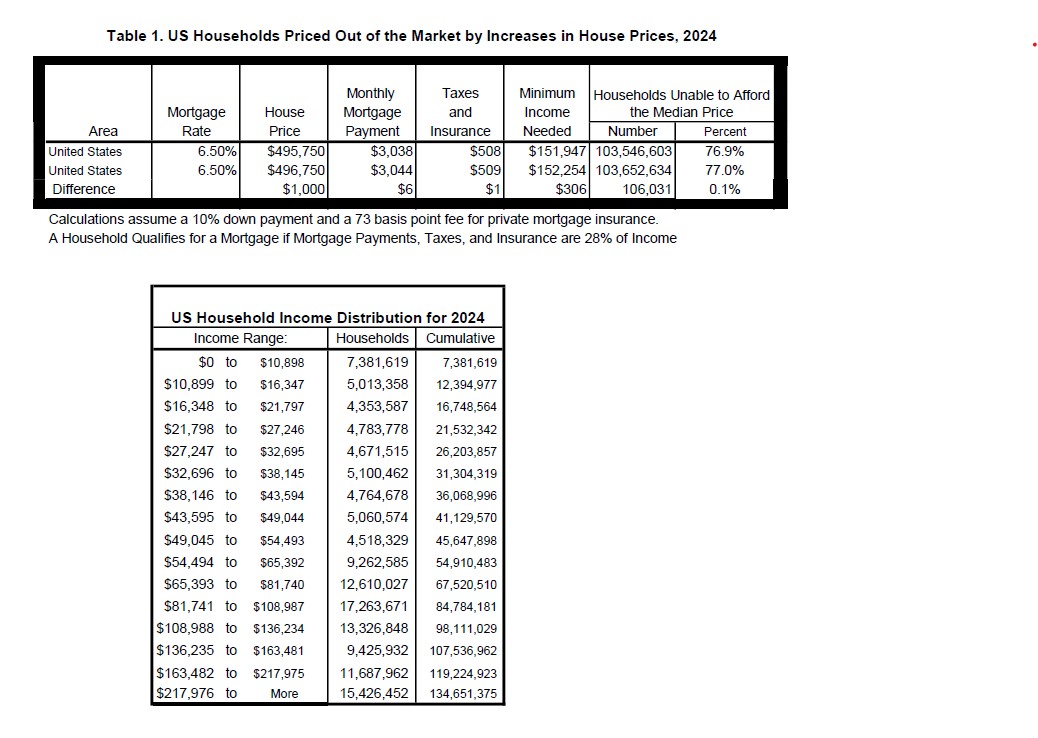

NAHB recently updated its 2024 priced out estimates, showing how higher prices and interest rates affect housing affordability. The new estimates show that affordability is a serious problem even before any further price or interest rate increases. Already in 2024, 103.5 million households are not able to afford a median priced new home ($495,750[1]). This is because their incomes are insufficient to qualify for the required mortgage under standard underwriting criteria. If the median new home price goes up by $1,000, an additional 106,031 households would be priced out of the market.

The underwriting criterion used to determine affordability is that the sum of mortgage payments, property taxes, homeowners and private mortgage insurance premiums (PITI) during the first year is no more than 28 percent of the household’s income. Key assumptions include a 10% down payment, a 30-year fixed rate mortgage at an interest rate of 6.5%, and an annual premium starting at 73 basis points for private mortgage insurance.

The 2024 priced-out estimates for all states and the District of Columbia and over 300 metropolitan statistical areas are shown in the map below. This map shows detailed information, including the projected 2024 median new home price estimates and the minimum income to secure a mortgage, and the percentage of households unable to afford the new homes. It also shows how a $1,000 increase in price could impact the number of households. Vermont stands out as the state with the highest share of households unable to afford the median-priced new home before any price changes, with approximately 92% of its households falling short on the income needed for a mortgage to buy a median-priced new home. Connecticut and Hawaii follow closely, with 89% and 88.5% of households respectively, facing similar affordability challenges for new homes at the median prices. On the other hand, Virginia is the state with much better affordability, where the median new home price is $462,000, however, around 66% of households still find these new homes unaffordable.

San Jose-Sunnyvale-Santa Clara metro area in California stands out due to its exceptionally high median new home price of $1,685,593, requiring a minimum household income of $487,773. This makes it the metro area with the highest percentage of households unable to afford the median-priced new homes. In contrast, the Washington, DC metro area presents a more accessible market, where around 37% households are capable of purchasing new median-priced homes. This indicates a relatively higher level of affordability compared to San Jose metro area.

More details, including priced out estimates for every state and over 300 metropolitan areas, and a description of the underlying methodology, are available in the full study.

[1] The 2024 US median new home price is estimated by projecting the 2022 preliminary median new home price using the NAHB forecast of the Case-Shiller Home Price Index.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.