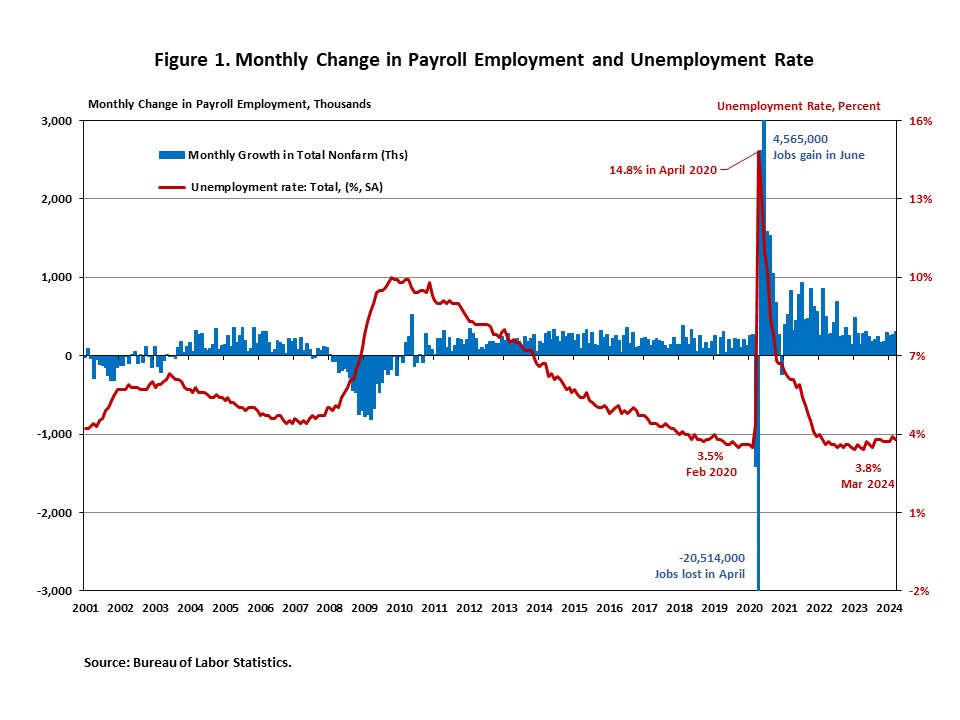

Job growth accelerated in March, following a strong gain in February. Furthermore, the unemployment rate fell to 3.8%. March’s jobs report shows that the labor market remains resilient despite elevated interest rates. The strong job numbers likely reduce prospects for a Federal Reserve rate cut in the near-term (NAHB has just two rate cuts in our forecast for 2024).

Also, for March 2024, we saw the wage growth slow down. On a year-over-year basis (YOY), wages grew 4.1% in March, the lowest annual gain since June 2021. Wage growth is positive if matched by productivity growth. If not, it can be a sign of lingering inflation.

Total nonfarm payroll employment increased by 303,000 in March, greater than the downwardly revised increase of 270,000 jobs in February, as reported in the Employment Situation Summary. This marks the largest monthly gain in the past ten months and the 39th straight month of gain. The monthly change in total nonfarm payroll employment for January was revised up by 27,000, from +229,000 to +256,000, while the change for February was revised down by 5,000 from +275,000 to +270,000. Combined, the revisions were 22,000 higher than the original estimates. Despite restrictive monetary policy, nearly 7.3 million jobs have been created since March 2022, when the Fed enacted the first interest rate hike of this cycle. In the first three months of 2024, 829,000 jobs were created, and monthly employment growth averaged 276,000 per month, compared with a 251,000 monthly average gain in 2023.

In March, the unemployment rate fell to 3.8%, from 3.9% in February. The number of unemployed persons declined by 29,000 to 6.4 million, while the number of employed persons rose by 498,000.

Meanwhile, the labor force participation rate, the proportion of the population either looking for a job or already holding a job, rose two percentage points to 62.7%. It marks the first increase since November 2023. Moreover, the labor force participation rate for people aged between 25 and 54 ticked down to 83.4%. While the overall labor force participation rate is still below its pre-pandemic levels at the beginning of 2020, the rate for people aged between 25 and 54 exceeds the pre-pandemic level of 83.1%.

The health care (+72,000), government (+71,000), and construction (+39,000) sectors led March’s job gains, while employment in manufacturing, wholesale trade, transportation and warehousing, information, financial activities, and professional and business services showed little or no change in March. Employment in leisure and hospitality has returned to its pre-pandemic level in February 2020.

Employment in the overall construction sector increased by 39,000 in March, following an upwardly revised 26,000 gains in February. While residential construction gained 14,400 jobs, non-residential construction employment added 24,600 jobs for the month.

Residential construction employment now stands at 3.3 million in March, broken down as 941,000 builders and 2.4 million residential specialty trade contractors. The 6-month moving average of job gains for residential construction was 5,500 a month. Over the last 12 months, home builders and remodelers added 78,800 jobs on a net basis. Since the low point following the Great Recession, residential construction has gained 1,366,300 positions.

In March, the unemployment rate for construction workers declined to 4.3% on a seasonally adjusted basis. This marks the lowest rate in the past nine months. The unemployment rate for construction workers remained at a relatively lower level, after reaching 14.2% in April 2020, due to the housing demand impact of the COVID-19 pandemic.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Last year job gains were overstated by almost one-half million. In an election year, can we be certain this trend will not continue?

I’m a little perplexed that the job growth numbers seem to come as a surprise.

With government at an all-time high in 2023 and a porous southern border allowing the flow of millions of immigrants

What would a person expect the job growth numbers to look like?

Seems a little counterproductive to maintain these high levels of spending and then try to control inflation with higher interest rates.

You have to ask

Yourself, who is being rewarded and who is being punished with these policies?