Financial conditions continue to be tight, as the 10-year Treasury rate stands near 4.8% this morning. Among the factors leading to higher rates (more debt issuance, higher-for-longer monetary policy expectations, long-term fiscal deficit conditions, and strong current GDP growth data for the third quarter) is an ongoing, elevated count of open jobs for the overall economy.

In September, the number of open jobs for the economy as a whole remained large at 9.55 million. Despite higher interest rates, this is only slightly lower than the 10.9 million reported a year ago. NAHB estimates indicate that this number must fall back below 8 million for the Federal Reserve to feel more comfortable about labor market conditions and their corresponding impact on inflation.

While the Fed intends for higher interest rates to have an impact on the demand-side of the economy, the ultimate solution for the labor shortage will not be found by slowing worker demand, but by recruiting, training and retaining skilled workers. This is where the risk of a monetary policy mistake can be found. Good news for the labor market does not automatically imply bad news for inflation.

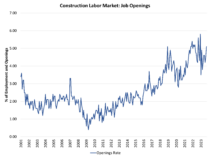

The construction labor market saw an increase in the interest for hiring in September. The count of open construction jobs increased to 431,000 in September after a revised reading of 375,000 in August. The count was 466,000 a year ago, during a period of housing market cooling. These estimates come after a data series high of 488,000 in December 2022. Despite recent tightness, the overall trend is one of cooling for open construction sector jobs as the housing market slows and backlog is reduced, with a notable uptick in month-to-month volatility since late last year.

The construction job openings rate increased to 5.1% in September. The recent trend of these estimates points to the construction labor market having peaked in 2022 and is now entering a stop-start cooling stage as the housing market adjusts to higher interest rates.

Despite expected, future weakening in the final quarter of 2023, the housing market remains underbuilt and requires additional labor, lots and lumber and building materials to add inventory. Hiring in the construction sector fell back to a 3.8% rate in September after 4.6% in August. The post-virus peak rate of hiring occurred in May 2020 (10.4%) as a post-covid rebound took hold in home building and remodeling.

Construction sector layoffs fell back to 1.9% in September after 2.2% in August. In April 2020, the layoff rate was 10.8%. Since that time, the sector layoff rate has been below 3%, with the exception of February 2021 due to weather effects and March 2023 due to some market churn.

Looking forward, attracting skilled labor will remain a key objective for construction firms in the coming years. While a slowing housing market will take some pressure off tight labor markets, the long-term labor challenge will persist beyond the ongoing macro slowdown.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.

As open construction jobs increase, the industry signals growth. Prospective builders should seize opportunities, and considering construction loans becomes integral for those aiming to fill these positions and contribute to the expanding landscape of construction projects.