NAHB analysis of Census Construction Spending data shows that total private residential construction spending rose 1.1% in December after an increase of 0.7% in November 2021. Spending stood at a seasonally adjusted annual rate of $810.3 billion. Total private residential construction spending was 15.0% higher than a year ago.

These monthly gains are attributed to the strong growth of spending on single-family and multifamily construction, while spending on improvements slipped. Single-family construction spending increased to a $435 billion annual pace in December, up by 2.1% over the upwardly revised November estimates. Multifamily construction spending rose 0.4% in December. Spending on improvements slipped 0.1% in December, after a dip of 0.8% in November. Home building is still facing supply chain issues, which means the industry is dealing with rising material costs as well as ongoing labor shortages.

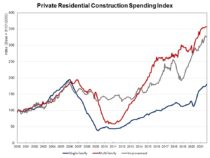

The NAHB construction spending index, which is shown in the graph below (the base is January 2000), illustrates the solid growth in single-family construction and home improvement from the second half of 2019 to February 2020, before the COVID-19 hit the U.S. economy, and the quick rebound since July 2020. New multifamily construction spending has picked up the pace after a slowdown in the second half of 2019. Under the pressure of supply-chain issues, construction spending on single-family, multifamily and improvements slipped down a bit from the third quarter of 2021.

Private nonresidential construction spending stayed relatively unchanged in December from the upwardly revised November estimates. And it was 9.1% higher than a year ago. The largest month-over-month nonresidential spending increase was made by the class of office ($0.49 billion), followed by amusement and recreation ($0.4 billion), and class of lodging ($0.37 billion).

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.