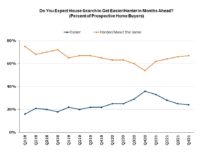

In early 2018, only 16% of home buyers expected that finding a home would be easier in the months ahead. The share soared during the early phase of the pandemic, reaching 36% by the end of 2020. But in 2021, buyers’ perceptions of housing inventory worsened throughout the year, and by the fourth quarter, only 24% expected easier availability ahead – the lowest since the end of 2019. The decline in expectations accurately reflects the large imbalance between housing demand and supply (particularly existing homes) seen in 2021.

Across regions, only 19% of buyers in the South had expectations at the end of 2021 that housing availability will ease up – the lowest share since the end of 2018. In fact, all regions show a decline in buyers’ perceptions of inventory during the year ended in the fourth quarter of 2021. During this period, the share of Gen X buyers who expect easing inventory conditions plummeted from 43% to 17%.

Another way to assess buyers’ perceptions on inventory is to ask whether they are seeing more/fewer/about the same number of homes (that they like and can afford) available on the market. Results to this question further confirm a decline in buyer’s perceptions of housing availability: the share of buyers seeing more homes available on the market fell to 31% in the final quarter of 2021, down from 41% a year earlier.

Between the third and fourth quarter of 2021, the share of buyers seeing better availability either declined or remained unchanged in all four Census regions: Northeast (38% to 36%), Midwest (26% to 24%), South (flat at 25%), and West (flat at 36%). In fact, the shares in all regions were lower at the end of 2021 than at the end of 2020.

* The Housing Trends Report is a research product created by the NAHB Economics team with the goal of measuring prospective home buyers’ perceptions about the availability and affordability of homes for-sale in their markets. The HTR is produced quarterly to track changes in buyers’ perceptions over time. All data are derived from national polls of representative samples of American adults conducted for NAHB by Morning Consult. Results are seasonally adjusted. A description of the poll’s methodology and sample characteristics can be found here. This is the third in a series of six posts highlighting results for the fourth quarter of 2021. See previous posts on plans to buy and new vs. existing preference.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.