Specialty contractors structured as partnerships generated aggregate net income of $4.5 billion in 2014, according to the most recent IRS data available.[1]

These data are broken out by industry and income tax deductions, allowing us to compare the use of tax deductions by partnerships across a wide array of sectors.

Analyzing the size of depreciation and business interest deductions taken by specialty contractors gives insight into how much capital the industry employs (using the depreciation deduction as a proxy) and how debt-reliant it is (using interest deductions). These figures can then be compared to those of other industries to better understand specialty contractors’ unique place among small businesses.

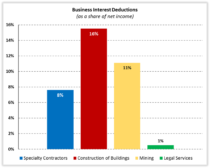

To normalize the data across industries, depreciation and interest deductions are presented as a share of net income. The importance of certain deductions to construction firms and specialty contractors in particular—relative to businesses in other industries—provides insight into the unique nature of the industry. Using net income as a common denominator lets us compare the importance of these deductions to the health and viability of businesses ranging from construction to legal services firms.

The table below shows the net income, depreciation, and business interest deduction information of four industries: specialty contractors, construction of buildings, mining, and legal services.

The average deduction for depreciation per specialty contractor partnership in 2014 was nearly one-fifth the size of its net income. In stark contrast, depreciation deductions taken by legal services and mining partnerships averaged 2% and 34%, respectively, of their net income. Deductions for business interest expenses vary almost as much by industry (below).

The breadth of the IRS data makes it possible to calculate where any of these metrics of the average business in a specific industry fall in the distribution. For instance, as shown above, the average legal services partnership has a net profit margin of 36%, placing legal firms in the 90th percentile. Simply put, out of the roughly 100 industries examined here, partnerships in legal services boast higher margins than 90% of those in other industries.

The picture that emerges is clear. Contractors operate within lower net incomes (36th percentile) than businesses in most industries. Additionally, specialty contractors need a large amount of capital and available credit relative to service-providing industries (other than construction) to thrive. These facts underscore the importance of certain deductions to contractors as well as the disparate effects that public policy concerning depreciation and interest expenses can have on businesses in different industries.

[1] IRS data on partnerships include some LLCs. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner’s tax return as “disregarded entity.”

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.