The Census Bureau’s quarterly summary of State & Local Tax Revenue shows a 1.7% increase in property taxes paid, rising from a revised estimate of $754.1 to $766.7 billion in the seasonally adjusted four quarters ending in the first quarter of 2024.

The rate of quarterly increases ticked up slightly, up from 1.5% in the fourth quarter of 2023 to 1.7% in the first quarter of 2024. This was the sixth straight quarter where the quarterly percentage increase was above the historical average since 2011 of 0.9%.

Year-over-year, property tax revenue was 8.9% higher. This was the third straight decrease in the year-over-year rate of change in the property tax data. Despite this, the first quarter of 2024 still experienced a year-over-year increase that is double what it has historically been.

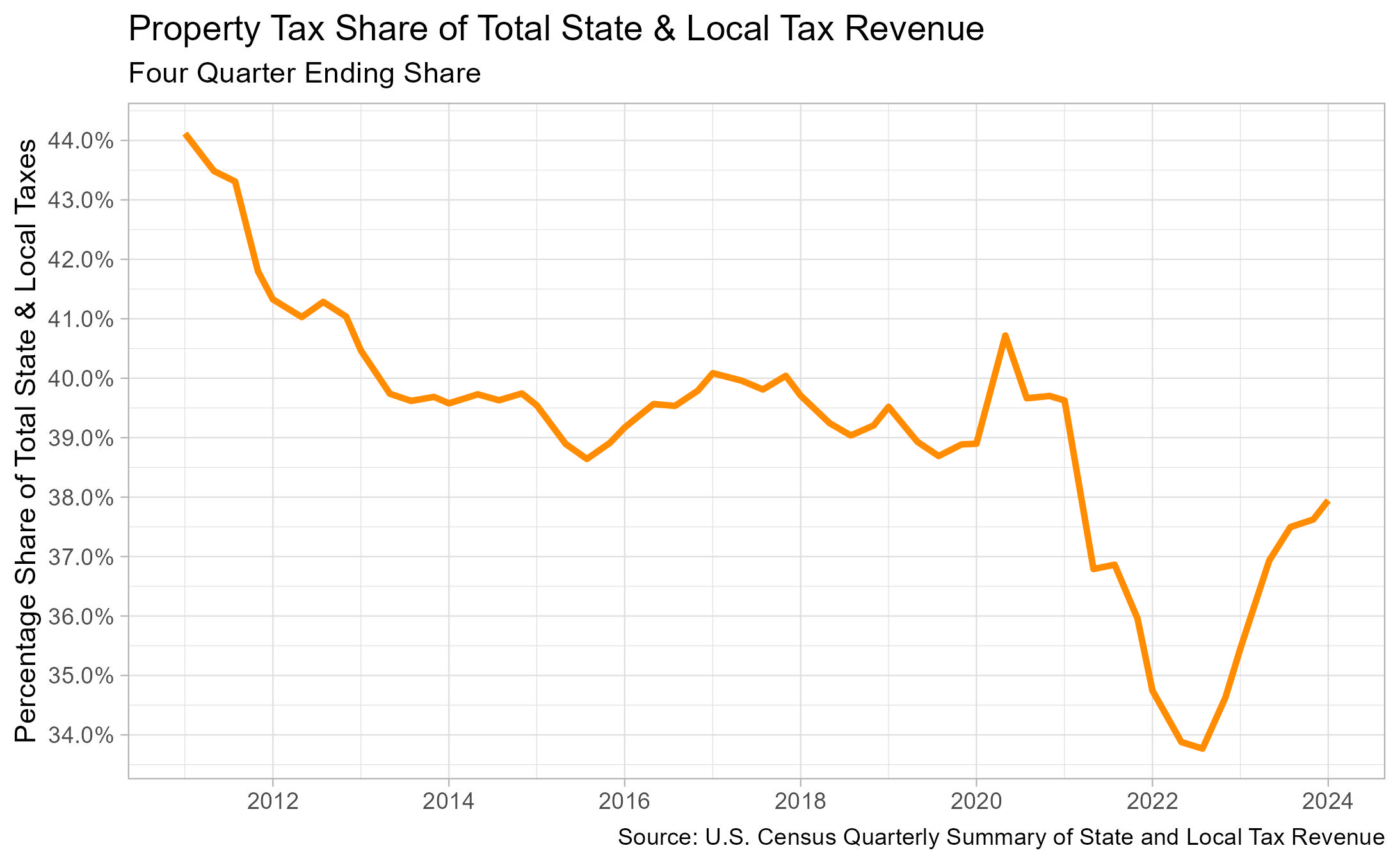

Property tax share of total state & local tax collections in the first quarter stood at 37.9%, up a marginal 0.3 percentage points from the previous quarter. This share had been trending upward since the third quarter of 2022 when it was at 33.7%.

Of total collections, property tax made up the largest share, followed by sales at 28.4%. Individual income tax represented 25.2% of tax revenue, while corporate tax made up the remaining 8.4% of revenues for state & local governments in the first quarter of 2024.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This is a fantastic and well-researched analysis! The data on property tax revenue and its consistent growth is presented with exceptional clarity. Thank you for providing such an insightful breakdown of the latest state and local tax trends.