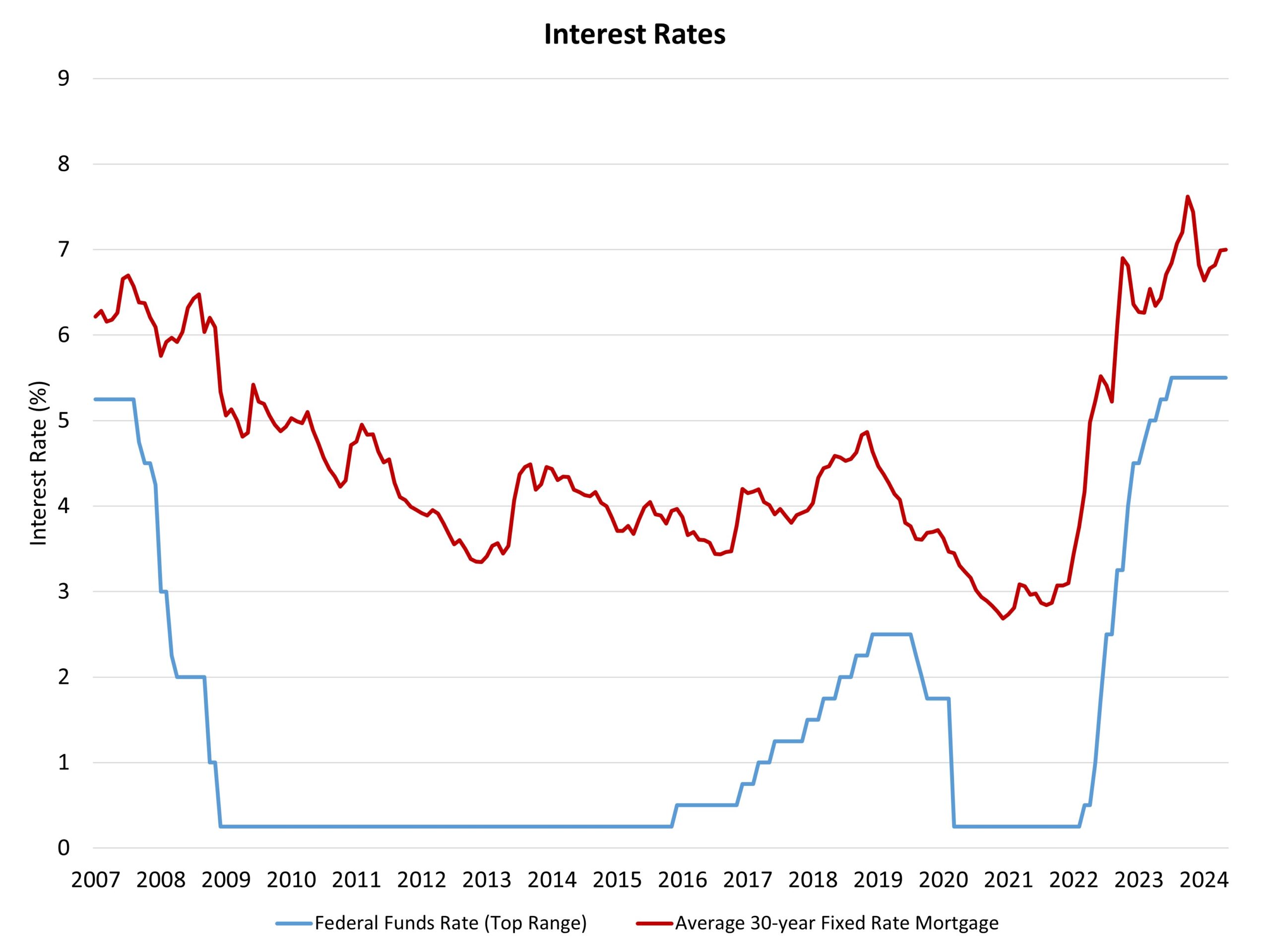

The Federal Reserve’s monetary policy committee held constant the federal funds rate at a top target of 5.5% at the conclusion of its June meeting. In its statement, the Federal Open Market Committee (FOMC) noted:

Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. In recent months, there has been modest further progress toward the Committee’s 2 percent inflation objective.

Compared to the Fed’s May statement, the current statement upgraded “lack of progress” stated in May to “modest further progress” referred to this month with respect to achieving the central bank’s 2% inflation target. The FOMC’s statement also noted (consistent with its commentary in May):

The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

Overall, the central bank continues to look for sustained, lower inflation readings, with the data having shown insufficient progress during the first quarter. The May CPI data was a step in the right direction, but the central bank will remain data dependent with respect to an eventual easing of monetary policy.

An important reason for the lack of recent inflation reduction remains elevated measures of shelter inflation, which can only be tamed in the long-run by increases in housing supply. Ironically, higher interest rates are preventing more construction by increasing the cost and limiting the availability of builder and developer loans necessary to construct new housing.

Chair Powell noted the challenges for housing in the current environment. He stated that the “housing situation is complicated.” He indicated that the best thing the Fed could do for the housing market would be “to bring inflation down, so that we can bring rates down.” However, Chair Powell noted that “there will still be a national housing shortage as there was before the pandemic.” We agree. The housing market requires non-monetary policy help on the supply-side of the industry, including labor force development and zoning reform, to address the housing shortage.

The Fed also published new economic projections with the conclusion of its June meeting. These projections include a consensus expectation of just one rate cut in 2024, consistent with NAHB’s current economic forecast. While this is a reduction in rate cuts from the March outlook, the policy bias is clearly toward lower rates in the near-term, not rate hikes. The projections reveal that the Fed does not expect to fully achieve its 2% inflation target on the core PCE inflation measure until 2026.

The rest of the Fed’s macro forecast was relatively unchanged. The Fed is expecting a 2.1% GDP growth rate (year-over-year for the fourth quarter) for 2024 and 2% for 2025. The Fed’s outlook for labor markets remains robust despite tighter financial conditions. The forecast is for a rise in unemployment to just 4.2% for the final quarter of 2025.

A notable change was made to the Fed’s long-run projection for the federal funds rate. The March forecast saw a long-run federal funds rate of 2.5% to 3.1%. This was increased in the June outlook to a 2.5% to 3.5% range. While this is a theoretical measure, it does reflect a change in the Fed’s thinking regarding economic growth. Because this rate range increased, and the Fed’s long-run GDP growth forecast did not increase, it indicates that the Fed expects higher rates will be needed in the years ahead to maintain relatively neutral monetary policy in the theoretical long-run.

In the short-run, the NAHB Economics team’s focus continues to be on the interplay between Fed monetary policy and the shelter/housing inflation component of overall inflation. With more than half of the overall gains for consumer inflation due to shelter over the last year, increasing attainable housing supply is a key anti-inflationary strategy, one that is complicated by higher short-term rates, which increase builder financing costs and hinder home construction activity. For these reasons, policy action in other areas, such as zoning reform and streamlining permitting, can be important ways for other elements of the government to fight inflation.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.