Per the Mortgage Bankers Association’s (MBA) survey through the week ending March 1st, total mortgage activity increased 9.7% from the previous week, and the average 30-year fixed-rate mortgage (FRM) rate fell two basis points to 7.02%. The 30-year FRM has risen 22 basis points over the past month as rates remain right around seven percent.

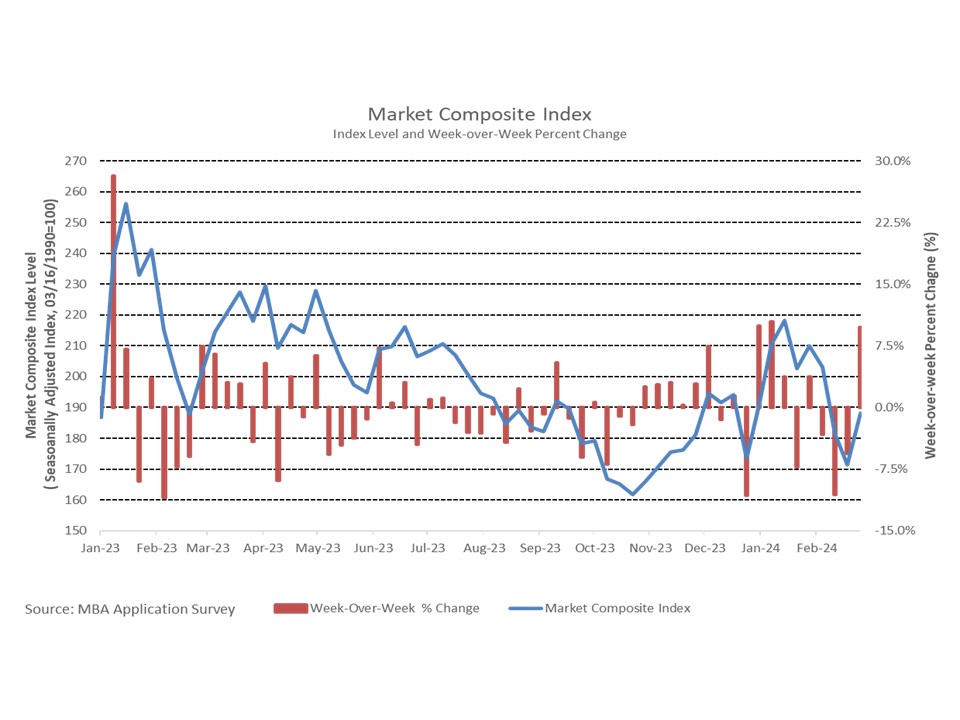

The Market Composite Index, a measure of mortgage loan application volume, rose by 9.7% on a seasonally adjusted (SA) basis from one week earlier after falling for three consecutive weeks. Both purchasing and refinancing activity rose, purchasing activity increased 10.6% and refinancing activity increased 8.1% week-over-week.

Purchasing activity continued to be lower than a year ago, down 8.6% compared to the same week last year. Refinancing activity saw a moderate pickup as rates fell from October through the start of the year but slowed as activity for the week ending March 1st was 2.2% lower than a year ago.

The refinance share of mortgage activity fell from 31.2% to 30.2% over the week, while the adjustable-rate mortgage (ARM) share of activity rose from 7.5% to 7.7%. The average loan size for purchases was $442,500 at the start of March, up from $436,200 over the month of February. The average loan size for refinancing decreased from $260,300 in February to $252,700 in March. The average loan size for an ARM was up at the start of March to $955,300, while the average loan size for a FRM rose to $337,300. Since March 2020, when COVID-19 was first declared a nationwide emergency, refinance and purchase average loan sizes have diverged from each other. Both amounts were near $343,000 in March 2020. As of the latest release, the average purchase loan size has risen by approximately $100,000 since 2020, while the average loan size for refinance has moved in the opposite direction falling about $90,000 over the same period.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This article indicates a rebound in mortgage activity after a three-week decline, signaling continued interest in home financing. For construction loans, this uptick suggests sustained demand for residential properties, reinforcing the need for lenders to offer accessible and competitive financing options to support both new construction projects and home purchases.