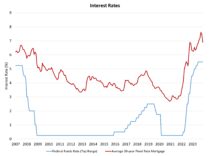

The Federal Reserve’s monetary policy committee held the federal funds rate constant at a top target rate of 5.5% at the conclusion of its December meeting. The Fed will continue to reduce its balance sheet holdings of Treasuries and mortgage-backed securities as part of quantitative tightening and balance sheet normalization. Marking a third consecutive meeting holding the federal funds rate constant, it now appears the Fed has ended its tightening of monetary policy. Nonetheless, elevated rates will continue to place downward pressure on economic activity, thereby slowing inflation, as it recedes to the Fed’s target of 2% over the course of 2024 and 2025.

The Fed’s statement noted that “growth of economic activity has slowed” and “inflation has eased over the past year but remains elevated.” While it appears the Fed is done raising the federal funds rate, the door was kept open for additional increases if inflation were to trend higher. The statement declared this willingness by noting “in determining the extent of any additional policy firming that may be appropriate to return inflation to 2 percent over time” the Fed will take into account the lags of policy and other economic conditions. The Fed however missed an opportunity here to cite the outsized role shelter inflation has played in recent CPI reports. The high cost of development and home construction is slowing the fight against inflation. State and local governments could assist the fight against inflation by addressing the root causes of these rising costs.

Looking forward, the Fed’s updated economic projections suggest three rate cuts next year. While this is one lower than current bond market expectations, it is one more than many forecasters (including NAHB) built into their 2024 base case only a few months ago. The Fed’s projections envisioned only two rate cuts in 2024 at their September policy meeting. While the federal funds rate will likely have a lower top rate of 4.75% this time next year, the Fed will continue reducing its balance sheet, thereby maintaining an elevated spread between the 10-year Treasury rate and rates for 30-year fixed rate mortgages.

The 10-year Treasury rate, which partially determines mortgage rates, dipped below 4% after the Fed announcement. This suggests mortgage rates will move below 7% in the weeks ahead. This is the lowest 10-year rate since August.

The Fed’s economic indicates a softish landing for the economy (although it is worth noting the economy did experience declining GDP growth for two quarters at the start of 2022 and a housing recession that spanned most of that year). The Fed’s projections also show a strong labor market, with the unemployment rising not much higher than 4%. The projections suggest three 25 basis point decreases in 2024 with another 100 basis points of cuts in 2025 taking the top target for the federal funds rate to 3.75%. This outlook is generally consistent with mortgage rates settling into a range somewhat above 5% by the end of 2025. This is an improved outlook for housing demand over the next two years, one that occurs amidst a persistent housing deficit.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.