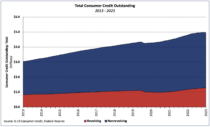

Consumer credit outstanding growth slowed to 0.4% in the third quarter of 2023 (SAAR) according to the Federal Reserve’s latest G.19 Consumer Credit report, as revolving debt grew 8.6% and nonrevolving debt declined 2.4%. On a monthly basis, revolving credit outstanding increased just 3.0% in September after surging 14.6% in August (SAAR).

Total consumer credit outstanding stands at $4.98 trillion (break-adjusted[1] and seasonally adjusted), with $1.29 trillion in revolving debt and $3.69 trillion in nonrevolving debt.

Seasonally adjusted revolving and nonrevolving debt accounted for 25.9% and 74.1% of total consumer debt, respectively. Revolving consumer credit outstanding as a share of the total increased 0.5 percentage point over the quarter and is the highest since Q1 2019.

Auto and Student Loan Debt

With every quarterly G.19 report, the Federal Reserve releases a memo item covering student and motor vehicle loans’ outstanding. Together, student and auto loans made up 88.6% of nonrevolving credit balances (NSA)—tied for the smallest share since Q1 2011 and equal to the share one year ago.

The balance of student loans decreased 1.6% in the third quarter (not seasonally adjusted), superseding a prior month’s report that showed a $30.0 billion increase. In contrast, the amount of auto loan debt outstanding increased $14.2 billion and stands at $1.53 trillion (NSA).

[1] The results of the 2020 Census and Survey of Finance Companies–delayed by the pandemic–are now incorporated in the Consumer Credit (G.19) statistical releases and include large revisions dating back to June 2021. Rather than retain the large spike in credit that now appears in the raw data, we have used the “break-adjusted” historical time series developed by Moody’s Analytics and will continue to do so moving forward. Click here for more information.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.

The slow growth in consumer debt since 2020 may create a favorable environment for prospective homebuilders. Exploring construction loans during this period could offer builders a strategic advantage, enabling them to initiate projects with minimized financial risks and capitalize on the current economic landscape.