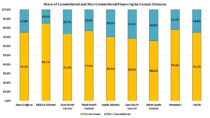

NAHB analysis of the 2022 Census Bureau Survey of Construction (SOC) data shows that, nationwide, the share of non-conventional financing for new home sales accounted for 28.1% of the market, roughly the same as in 2021, at 28.8%. As in previous years, conventional financing dominated the market at 71.9% of sales. In 2020, the share of non-conventional financing was 34.4% of the market while conventional financing accounted for 65.6% of the market share.

Non-conventional forms of financing, as opposed to conventional mortgage loans, include loans insured by the Federal Housing Administration (FHA), VA-backed loans, cash purchases and other types of financing such as the Rural Housing Service, Habitat for Humanity, loans from individuals, state or local government mortgage-backed bonds. The reliance on non-conventional forms of financing varied across the United States, with its share at 34.0% in West South Central but accounting for only 14.9% of new single-family home starts in the Middle Atlantic division.

Nationwide, cash purchases were the majority share of non-conventional financing of new home purchases, accounting for 13% of the market share up from 11% in 2021. FHA-backed loans accounted for 8% which is lower than in 2021, where it was 11% of the market share. The share of VA-backed loans was at 4% market share in 2021 while Other Financing was 3% of market share.

Cash financing dominated non-conventional forms of financing in East South Central, where 24.2% of all homes started were purchased with cash. Except for West South Central, cash purchases led non-conventional financing all other census regions. Cash purchases accounted for 23.3% in New England, 10.1% in Middle Atlantic, 17.6% in East North Central, 12.6% in West North Central, 12.1% in South Atlantic, 10.3% in Mountain, and 9.7% in Pacific.

FHA-backed loans accounted for the majority of all non-conventional financing in the West South Central division accounting for 12.9% of the homes started. New England division reported the lowest FHA-backed loans with none of the homes started in 2022 were purchased with FHA-backed loans.

VA-backed loans were most used in the Mountain division, which accounted for 6.7% of non-conventional forms of financing. In New England, VA-backed loans were only 0.3%, the lowest market share for this category.

Other financing such as the Rural Housing Service, Habitat for Humanity, loans from individuals, state or local government mortgage-backed bonds was highest in West South Central where it was 6.3% of market share, while Middle Atlantic division reported the lowest share at 0.6%.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

It suggests that alternative financing options, like private lenders or specialized programs, can remain a consistent choice for construction projects. Builders should explore these options to find the most suitable construction loan terms for their specific needs. us at builderloans.net might help you for your construction project financing needs!