The most recent data release from the Bureau of Economic Analysis (BEA) showed that personal income increased 0.3% in June. The pace of personal income growth slowed after reaching a 0.7% monthly gain in January 2023. Gains in personal income are largely driven by increases in wages and salaries.

Real disposable income, income remaining after adjusted for taxes and inflation, inched up 0.2% in June. On a year-over-year basis, real (inflation adjusted) disposable income rose 4.7%, after experiencing negative year-over-year growth in 2022.

Personal consumption expenditures (PCE) rose 0.5% in June after a 0.2% increase in May. Real spending, adjusted to remove inflation, increased 0.4% in June, with spending on goods rising 0.9% and on services up 0.1%.

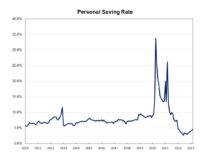

While spending increasing more than personal income, the June personal savings rate dipped to 4.3% in June from 4.6% in May. As inflation has almost eliminated compensation gains, people are dipping into savings to support spending.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

With increased income, potential homebuyers may find it easier to qualify for loans, potentially driving demand for new construction projects and supporting growth in the housing market. Check out builderloans.net to find out why and how we can get a clean and easy construction loan for you.