Private residential construction spending inched down 0.2% in March, as spending on single-family construction decreased 0.8%. Spending on private residential construction declined for the tenth month in a row amid elevated mortgage interest rates. Consequently, this spending is 10% lower compared to a year ago.

The monthly decline is largely attributed to lower spending on single-family construction, which has been declining since June 2022. Compared to a year ago, spending on single-family construction was 22.9% lower. This is consistent with a pull back for single-family home building, as surging interest rates cooled the housing market during 2022.

Multifamily construction spending increased by 0.4% in March, after an increase of 1.2% in January and 0.5% in February. This was 23% over the March 2022 estimates, largely due to the strong demand for rental apartments. Private residential improvement spending inched up 0.3% in March after two consecutively monthly declines. But it was 2.0% lower compared to a year ago.

Keep in mind that construction spending reports the value of property put-in-place. Per the Census definition: The “value of construction put in place” is a measure of the value of construction installed or erected at the site during a given period. The total value-in-place for a given period is the sum of the value of work done on all projects underway during this period, regardless of when work on each individual project was started or when payment was made to the contractors. For some categories, published estimates represent payments made during a period rather than the value of work done during that period.

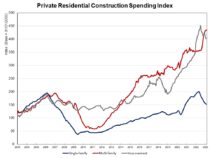

The NAHB construction spending index, which is shown in the graph below (the base is January 2000), illustrates how construction spending on single-family has slowed since early 2022 under the pressure of supply-chain issues and elevated interest rates. Multifamily construction spending has had solid growth in recent months, while improvement spending has slowed since mid-2022. Before the COVID-19 crisis hit the U.S. economy, single-family and multifamily construction spending experienced solid growth from the second half of 2019 to February 2020, followed by a quick post-covid rebound since July 2020.

Spending on private nonresidential construction increased by 1% in March to a seasonally adjusted annual rate of $607 billion. The monthly private nonresidential spending increase was mainly due to more spending on the class of manufacturing category ($6.4 billion), followed by the educational construction category ($0.3 billion).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.