According to the Federal Reserve Board’s January 2023 Senior Loan Officer Opinion Survey (SLOOS)—conducted for bank lending activity over the fourth quarter of last year—banks reported weaker demand for residential real estate (RRE) loans, home equity lines of credit (HELOCs), and commercial real estate (CRE) loans. Additionally, credit standards tightened across all categories of mortgage loans.

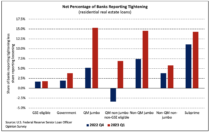

Residential real estate credit standards tightened across the board relative to the prior quarter. Mortgage lending standards tightened the most for non-QM jumbo, QM jumbo, and QM non-jumbo, non-GSE eligible RRE loans. In contrast, GSE-eligible loans saw only a small increase in the net percent of banks reporting tighter standards in Q1 2023 than Q4 2022.

Banks also reported weaker demand across residential real estate loan categories. The vast majority of banks reported weaker demand than the prior quarter.

The net share of banks reporting weaker demand reached 93.0% while the share was at least 85% for other types of RRE loans. The net percentage was a record for every loan category dating back to the inception of the series in 2015.

Lending standards for CRE loans broadly tightened as well. The largest increases in tightening over the prior quarter were for loans secured by multifamily residential properties (+17 percentage points to 57%) and construction and land development loans (+12 ppts to 69%). Banks also reported that demand for CRE loans all decreased and declined by more than they had the prior quarter.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.