In the second quarter iteration of the Federal Reserve Board’s Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices, banks reported largely unchanged lending standards across all residential real estate (RRE) loans. Major net shares of banks reported weaker demand for most RRE loans except for home equity lines of credit, for which a significant net share of banks reported stronger demand. The second quarter also saw tighter credit standards for Commercial Real Estate (CRE) loans and Commercial and Industrial (C&I) loans.

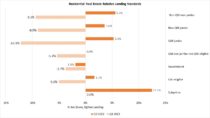

The below figure derived from the SLOOS shows that RRE credit standards relative to the first quarter of 2022, tightened by no more than 5.6 percent, except for subprime mortgages for which banks tightened standards by 12.5 percent. Government-issued mortgages, such as FHA and VA loans, were the only category of RRE loans that showed a loosening of credit standards, that too, by a negligible amount of -1.9 percent.

Although major net shares of most banks reported weaker demand for RRE loans, a small fraction of banks reported moderately to substantially stronger demand across all loan categories except subprime residential mortgages. For loans extended to homeowners based on their homes’ market values, a positive net share of 41.1 percent of banks surveyed reported moderately stronger demand for home equity lines of credit and 5.4 percent of banks reported substantially stronger demand.

Meanwhile, banks reported tighter lending standards for all Commercial Real Estate (CRE) loan categories and weaker demand in construction and land development loans and nonfarm nonresidential loans. A modest net share of banks, 6.1 percent, reported stronger demand for loans secured by multifamily residential properties. In Q1 2022, multifamily loans’ demand, on net, was 18.5 percent stronger. In the following quarter’s survey, 4.5 percent of banks reported substantially stronger demand, 18.2 percent indicated moderately stronger, and 60.6 percent of banks reported unchanged demand. The questions were subdivided between large commercial banks and other commercial banks.

In SLOOS’s last category, Commercial and Industrial (C&I) loans, banks reported a tightening of lending standards across all firm sizes, citing unfavorable economic conditions for the tightening. Thirty-three percent of banks reported moderately stronger demand for C&I loans made to large and middle-market firms while 29 percent of banks reported moderately stronger demand for loans made to small firms. Interestingly, the survey asks banks to use only funds disbursed to measure C&I loan demand.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.