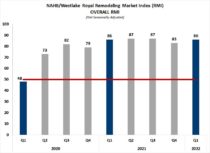

The NAHB/Westlake Royal Remodeling Market Index (RMI) for the first quarter of 2022 posted a reading of 86, unchanged from the first quarter of 2021. The RMI and all of its components and subcomponents were 80 or higher (on a scale of 0 to 100) indicating broad-based positive remodeler sentiment.

The RMI is based on a survey that asks remodelers to rate various aspects of the residential remodeling market “good,” “fair” or “poor.” Responses from each question are converted to an index that lies on a scale from 0 to 100, where an index number above 50 indicates that a higher share view conditions as good than poor.

The RMI is an average of two major component indices: the Current Conditions Index, and the Future Indicators Index. The Current Conditions Index, in turn, is an average of three subcomponents: the current market for large remodeling projects ($50,000 or more), moderately-sized projects ($20,000 to $49,999), and small projects (under $20,000).

In the first quarter of 2022, the Current Conditions component index was 89, remaining unchanged compared to the first quarter of 2021. Year-over-year, the subcomponent measuring large remodeling projects rose four points to 89, while the subcomponent measuring moderately-sized remodeling projects edged down one point to 89, and the subcomponent measuring small remodeling projects declined by two points to 90.

The Future Indicators Index is an average of two subcomponents: the current rate at which leads and inquiries are coming in and the current backlog of remodeling projects. In the first quarter of 2022, the Future Indicators Index was 82, down two points from the first quarter of 2021. Year-over-year, the subcomponent measuring the current rate at which leads and inquiries are coming in fell six points to 80, while the subcomponent measuring the backlog of remodeling jobs increased two points to 84.

The NAHB/Westlake Royal RMI was redesigned in 2020 to ease respondent burden and improve its ability to interpret and track industry trends. As a result, readings cannot be compared quarter to quarter until enough data are collected to seasonally adjust the series. To track quarterly trends, the redesigned RMI survey asks remodelers to compare market conditions to three months earlier, using a “better,” “about the same,” “worse” scale. In the first quarter of 2022, 72 percent of respondents said the remodeling market is “about the same” as it was three months earlier.

An overall RMI of 86 indicates positive remodeler sentiment and is consistent with NAHB’s projection of moderate growth in the remodeling market for 2022. However, rising interest rates and the high cost of materials are significant headwinds to the remodeling industry and the housing industry at large.

For the full set of RMI tables, including regional indices and a complete history for each RMI component, please visit NAHB’s RMI web page.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.