Data from the Survey of Market Absorption of Apartments (SOMA), produced by the Census Bureau, suggest continued improvement for the multifamily sector in the third quarter of 2021 due to strong demand and low vacancy rates.

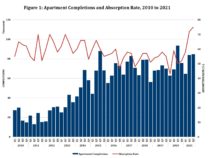

The absorption rate of unfurnished, unsubsidized apartments (the share rented out in the first three months following completion) surged by 25 percentage points to 75 percent in the third quarter of 2021 (from 50 percent in the second quarter of 2020), the highest rate since 2005 (Figure 1). Meanwhile, the number of apartments completed was down during this period, from 93,750 units in the third quarter of 2020 to 84,760 units in the third quarter of 2021 (about a 10 percent decrease).

The median asking rent for these apartments increased from $1,638 in the third quarter of 2020 to $1,690 in the third quarter of 2021 (a 3 percent gain). This is the third consecutive quarter with a year-over-year increase in the median asking rent price, albeit at a slower pace.

The SOMA also provides data on condominium completions and absorption (Figure 2). Condominium absorption increased to 70 percent in the third quarter of 2021 (from 69 percent in the third quarter of 2020). Meanwhile, condominium completions fell from 5,763 in the third quarter of 2020 to 3,204 in the third quarter of 2021.

The median asking sales price of condominiums increased marginally to $622,600 in the third quarter of 2021, virtually equaling the asking sales price of $622,400 in the third quarter of 2020.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.