In 2005, Congress established a number of energy-efficiency tax incentives related to housing that benefitted new home buyers and remodeling homeowners. These policies included the tax code section 45L credit for the construction of energy-efficient homes (including for-rent residences and low-rise apartments), the 25C credit for retrofitting/remodeling existing homes, and the 25D credit for the installation of power production property in new and existing homes.

Using prior IRS data, we examined total credit claims for the 25C and 25D credits, combined, in 2012. That data indicated declining use for the two credits in combination, but did not allow a breakout of use for each individual credit.

According to that prior NAHB analysis, total claims of the credits summed to $5.8 billion in 2009 and rose to $6.1 billion in 2010, before falling to $1.7 billion in 2011 and finally to $1.3 billion in 2012. Over the period of 2009 through 2012, more than 90% of all taxpayers claiming either credit had adjusted gross incomes (AGI) of less than $200,000 (93% for 2009 through 2011 and 91% in 2012).

The declining use of the 25C credit can be traced to recent rules changes. From 2009 through the end of 2010, the 25C credit for existing homes was available as a 30% credit and $1,500 limit. After the extension of the “tax extenders” legislation at the end of 2010, those rules were pared back and then retained when the credit was extended again as part of the Fiscal Cliff deal. Among those rule changes, the credit was reduced to a 10% rate and a $500 lifetime cap was imposed.

This version of the credit was extended twice but expired December 31st, 2016, as prescribed in the Protecting Americans from Tax Hikes (PATH) Act of 2015. Under the PATH Act, most energy efficiency tax credits expired at the end of 2016. One notable exception is credits for solar energy systems. Although these will remain available through tax year 2021, the value of the credit will begin to phase out after 2019 under the following schedule:

- 2017-2019: 30% of cost

- 2020: 26%

- 2021: 22%

- 2022: zero

New data from the IRS for tax year 2014 (the most recent available) has revealed how taxpayers are using these residential energy credits since 2012, with breakouts for 25C and 25D, respectively.

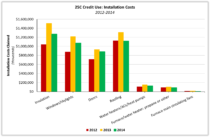

As in prior years, windows were the most common means for using the 25C credit.

In terms of costs claimed, however, qualified insulation improvements made up the largest share of the total.

In 2014, 705,000 taxpayers claimed a 25C credit via window upgrades connected to a total dollar value of $1.1 billion of improvements; the same amount was claimed by just 207,000 taxpayers for energy-efficient roof upgrades. After across-the-board increases in claims from 2012 to 2013, all categories of improvements experienced declines in 2014. These year-over-year changes occurred in terms of total installation costs claimed as well as returns filed.

A total of $4.57 billion of energy-efficient upgrades was claimed for credit calculation purposes on tax forms filed by 3.1 million taxpayers in 2014, yielding a total credit amount of $520 million (inclusive of carryforwards and the $500 lifetime cap).

The story of 25D is more mixed. While claims related to solar electric, solar water heating, and small wind energy property costs increased in 2014, those for costs related to geothermal heat pump fuel cell property dropped sharply. From 2013 to 2014, claims associated with solar electric power grew by 33,000 taxpayers and $381 million. Conversely, during the same period, 25D claims related to geothermal heat pumps fell by 5,000 taxpayers and $123 million, declines of 8% and 13%, respectively.

By far, the most commonly claimed qualifying activity for the 25D credit in 2014 was for solar electric property. Nearly 200,000 taxpayers claimed the credit for a total of almost $2.5 billion in qualifying costs of installation. The second most common installation in 2014 was for solar water heating property, which was claimed by 77,000 homeowners and totaled almost $276 million in installation costs. Despite the substantial decrease in costs associated with geothermal heat pumps, they still make up the second-largest share of total installation costs ($806 million) by a wide margin.

Including 154,000 returns using carryforwards of unclaimed credits, more than 400,000 taxpayers claimed a 25D credit in 2014. In total, $3.6 billion in 25D-qualifying installations were made in 2014, yielding credits totaling $1.1 billion.

Despite the changes associated with their use, the tax credits have been claimed in connection with billions of dollars of energy-efficient upgrades and new home features.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.