The prices of ready-mix concrete, gypsum, and softwood lumber fell 0.2%, 3.5%, and 0.1%, respectively, in January according to the latest Producer Price Index (PPI) release by the Bureau of Labor Statistics. OSB prices ticked up 1.8%, reversing the 1.3% price decline in December. Long-term trends in gypsum and ready-mix concrete prices are in focus this month, albeit for different reasons.

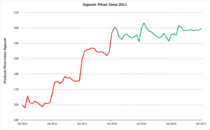

Gypsum prices seem to have found a new “normal” after steep price hikes at the beginning of 2012, 2013, and 2014. From 2011-2014 prices paid for gypsum increased 1.0% every month, on average. Since then, however, the trend has been stable as prices have averaged monthly gains of 0.1%, roughly in line with inflation. These contrasting trends are evidenced by the graph below, with red and green indicating times of increasing prices and price stability, respectively.

January marked only the fourth month since April 2011 that the price of ready-mix concrete has fallen. The graph below illustrates the upward momentum of prices over this period, as well as the striking infrequency of monthly price decreases (the largest of which was a paltry -0.2%). Over the same period, the 12-month change in the price of ready-mix concrete has averaged +3.5%, rising an aggregate 22%.

The economy-wide PPI increased 0.6% in January, double the percentage increase in December. Over 60% of the increase was driven by a 1.0% rise in prices paid for goods. Prices for final demand services moved up 0.3%. A 0.4% increase in the final demand prices for core goods (i.e. goods excluding food and energy) continued a positive trend that started with a 0.2% increase in November. Prices for core goods less trade services climbed 0.2%.

Over half of the rise in prices for goods—the fifth consecutive increase—was due to a steep (12.9%) increase in gasoline prices. In contrast, prices paid for beef and light trucks led declines among goods. Over 80% of the increase in prices for final demand services can be traced to margins of wholesalers and retailers. Car rental service prices fell 10.4% in January, nearly doubling the second-steepest decline among service subcategories (clothing wholesaling decreased by 5.3%).

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

Likely there will be some who call it a “bubble” but I’m guessing demand is still low due to still lower than average building levels.