New NAHB research based on the latest 2019 American Housing Survey (AHS) shows that, on average, homeowners spend around $9,240 per year to operate and maintain a single-family detached home. This includes property taxes, insurance, maintenance and utilities, with property taxes being the costliest component.

Annual operating costs increase consistently with household income, home size and value. When measured as a share of home’s value, annual operating costs average close to 5%, but the rate is smaller for newer homes (3% of the home’s value for homes built after 2010). The regional differences in operating costs are substantial as well, ranging from around $6,270 per year in the East South Central Division to over $13,000 in New England. This effect is primarily connected to taxes.

The largest component of operating costs are property taxes, accounting for just under $3,700, or 40% of the annual operating costs. Fuels – the second largest component of operating costs – average just over $2,500, or 27% of annual operating costs. Fuels include the costs of electricity, gas, oil or other fuel (wood, coal, kerosene, or other).

Home insurance is the next most expensive item on the operating costs list. On average, homeowners pay just over $1,250 to cover home insurance. In addition, homeowners spend close to $1,000 on maintenance – narrowly defined in the AHS as spending on minor routine repairs that do not include improvements and major repairs. Water and trash collection bills amount to $850, on average.

Not surprisingly, operating costs increase consistently as home size increases. For single family detached (SFD) homes under 1,000 square feet, home owners spend less than $6,600 per year. For homes that are between 1,000 and 1,500 square feet, the annual operating costs rise to over $7,000. For largest single-family detached homes with over 4,000 square feet, the operating costs approach $16,500, on average.

Because larger homes are typically more expensive, it is not surprising that higher-priced homes come with higher annual operating and maintenance costs. Similarly, newer homes have higher square footage and, consequently, have higher annual operating costs. To make the comparison more meaningful, annual operating costs are estimated as a fraction of the home’s value and compared across decades the home was built.

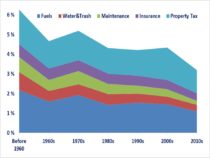

The clearest trend is for operating and maintenance costs to decline per dollar of value as the age of the home declines. On average, annual costs of running a home amount close to 5% of the home’s value. This fraction exceeds 6% for homes built before 1960. As homes get newer, costs per dollar of value tend to decline. Home owners of single-family detached homes built after 2010 spend an equivalent of 3% of the home’s value per year on operating their newer homes.

As illustrated in the chart below, for every cost component, with the exception of property taxes, costs per dollar of value tend to decline as homes become newer. For example, fuels on average cost 2.2% of the home’s value per year for homes built before 1960 but only half of that, 1.1%, for homes built after 2010.

Average Operating Costs as a Percent of Home Value by Year SFD Home was Built

How much homeowners spend on operating and maintaining their homes also depends on where they live. Homeowners in the two Northeast divisions – New England and Mid Atlantic – spend most on running their single-family detached homes – over $13,130 and $12,750 per year, respectively.

The two Northeast divisions register the highest average annual real estate taxes in the nation, approaching $6,000 in New England and $6,500 in Mid Atlantic (see Table 3). They also stand out for having the highest average annual fuel bills, with home owners paying over $3,880 in New England and $3,080 in Mid Atlantic. Homeowners here also spend significantly more on maintenance, averaging $1,230 in New England and $1,200 in Mid Atlantic. As a result, the annual home operating costs in these divisions exceed the national average of $9,240 by far.

Homeowners in the Pacific division, on average, face the most expensive homeowners’ insurance, as well as the highest water and trash bills. They also incur some of the highest property taxes and maintenance expenses in the nation. As a result, a typical homeowner in the Pacific division spends substantially more than the national average to operate and maintain a single-family detached home, with annual costs approaching $11,250.

At the other end of the spectrum is the East South Central division, known for low property taxes. The division also registers the lowest average maintenance, water and trash costs, and the second lowest homeowners’ insurance costs. As a result, home owners in the East South Central spend least to operate and maintain their single-family detached homes – $6,270 per year.

The complete NAHB report is available to the public as a courtesy of Housing Economics Online.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.

Great article and statistics. Interesting the jump, however, in costs stated in the article, from 1500 sf homes to “over 4000 sf” homes. What about the typical 2300 sf home or whatever NAHB calls “a national average” upon which the rest of their statistics are based, like costs of construction and regulatory costs.

Jeff — see Table 1 of the linked, underlying article. There’s a column for 2000-2499 sq ft homes.