Builder Confidence Steady but Future Sales Expectations Hit Six-Month High

Builder sentiment levels remained unchanged in September but lower mortgage rates and expectations that the…

Builder sentiment levels remained unchanged in September but lower mortgage rates and expectations that the Federal Reserve will soon cut the federal funds rate led to higher future sale expectations in the coming months. Builder confidence in the market for newly built single-family homes was 32 in September, unchanged from the August reading, according to…

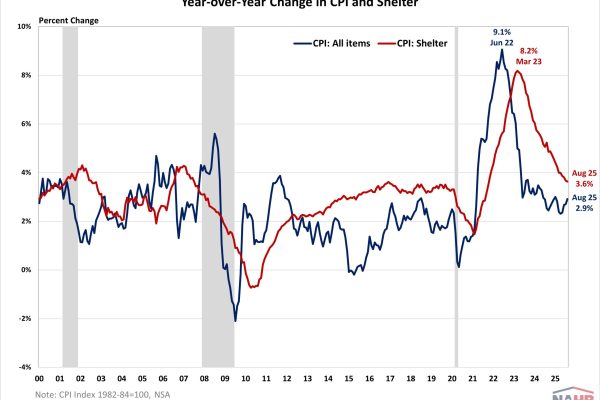

Inflation accelerated to a seven month high in August as tariff-related costs continued to pass through to consumers, according to the Bureau of Labor Statistics’ (BLS) latest report. Core goods prices, which exclude volatile food and energy, rose by 1.5% in August, the fastest annual pace since May 2023. Meanwhile, housing inflation continued to show…

Single-family housing permits slipped for the seventh month in a row, highlighting affordability headwinds and weak demand. While multifamily permits ticked up, the sector’s volatility leaves the outlook uncertain. The split underscores a housing market still under strain, with single-family softness weighing on broader growth prospects. Over the first seven months of 2025, the total…

The market value of household real estate assets rose to $49.3 trillion in the second quarter of 2025, according to the most recent release of U.S. Federal Reserve Z.1 Financial Accounts. The value rose by 2.7% from the first quarter and is 1.1% higher than a year ago. This measure of market value estimates the…

In 2024, 65% of newly completed single-family homes featured two-car garages, according to NAHB’s analysis of the Census’s Survey of Construction data. The share of new homes with three or more car garages stood at 15%, continuing a downward trend from its peak of 24% in 2015 and decreasing 2 percentage points from 2023. On…

Price growth for residential building materials rose for the fourth straight month in August, reaching its highest level since January 2023. Across domestic inputs goods and services into residential construction, service prices decreased in August while goods prices slightly advanced. Prices for inputs to new residential construction—excluding capital investment, labor, and imports—fell 0.1% in…

For the first time in 15 years, the share of new homes with patios finally declined in 2024, according to NAHB tabulation of data from the Survey of Construction (conducted by the U.S. Census Bureau with partial funding from the Department of Housing and Urban Development). Of the roughly 1.0 million single-family homes started during…