NAHB analysis of Census data shows that private residential construction spending rose 0.2% in January 2024, the second month of gains in a row. It stood at a seasonally adjusted annual pace of $900.8 billion.

The monthly increase in total construction spending is attributed to more single-family construction. Spending on single-family construction rose 0.6% in December. This is the ninth consecutive monthly increase since April 2023. It is aligned with the strong reading of 1.33 million single-family starts in January, as the lack of existing home inventory is boosting new construction. Compared to a year ago, spending on single-family construction is 12.5% higher. Multifamily construction spending went down 0.4% in January after an increase of 0.4% in December, as a large stock of multifamily housing is under construction. Private residential improvement spending inched down 0.1% in January and was 3.7% lower compared to a year ago.

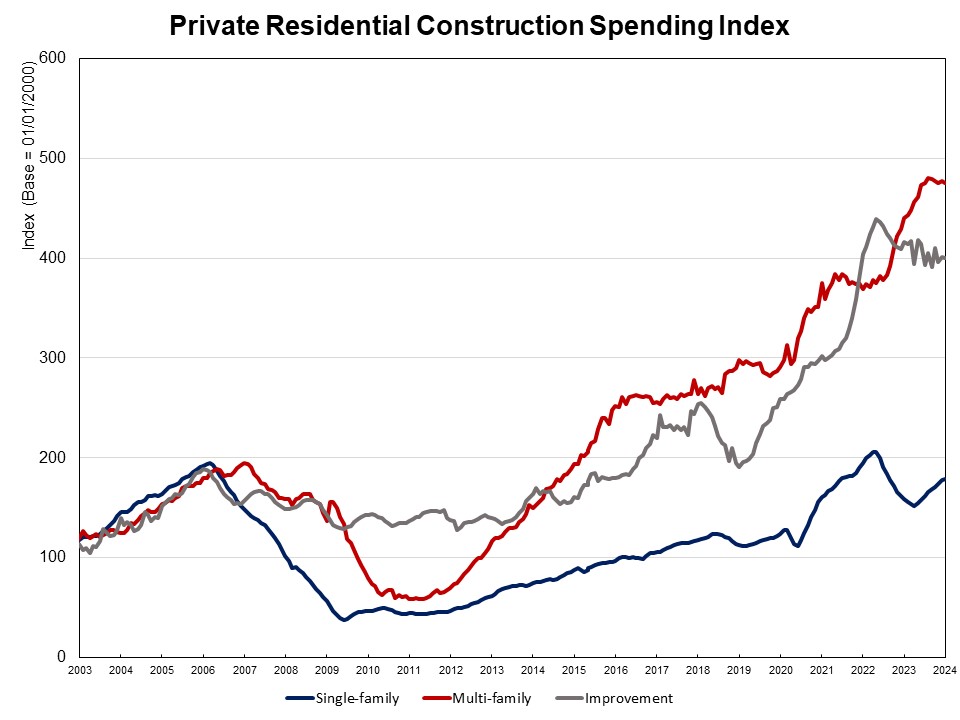

The NAHB construction spending index is shown in the graph below (the base is January 2000). It illustrates how spending on single-family construction experienced solid growth since May 2023 under the pressure of supply-chain issues and elevated interest rates. Multifamily construction spending growth stayed almost unchanged in the last three months, while improvement spending has slowed since mid-2022.

Spending on private nonresidential construction was up 15.2% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending on the manufacturing category ($60.1 billion), followed by the power category ($10.4 billion).

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.

This article emphasizes the continuous rise in single-family construction spending, indicating a buoyant housing market. For construction loans, this trend signifies sustained demand for financing solutions to support single-family home construction projects. Lenders can capitalize on this opportunity by providing tailored loan products to meet the needs of builders and developers, fostering growth in the residential construction sector.