A lack of existing inventory that continues to drive buyers to new home construction, coupled with strong demand and mortgage rates below last fall’s cycle peak, helped push builder sentiment above a key marker in March.

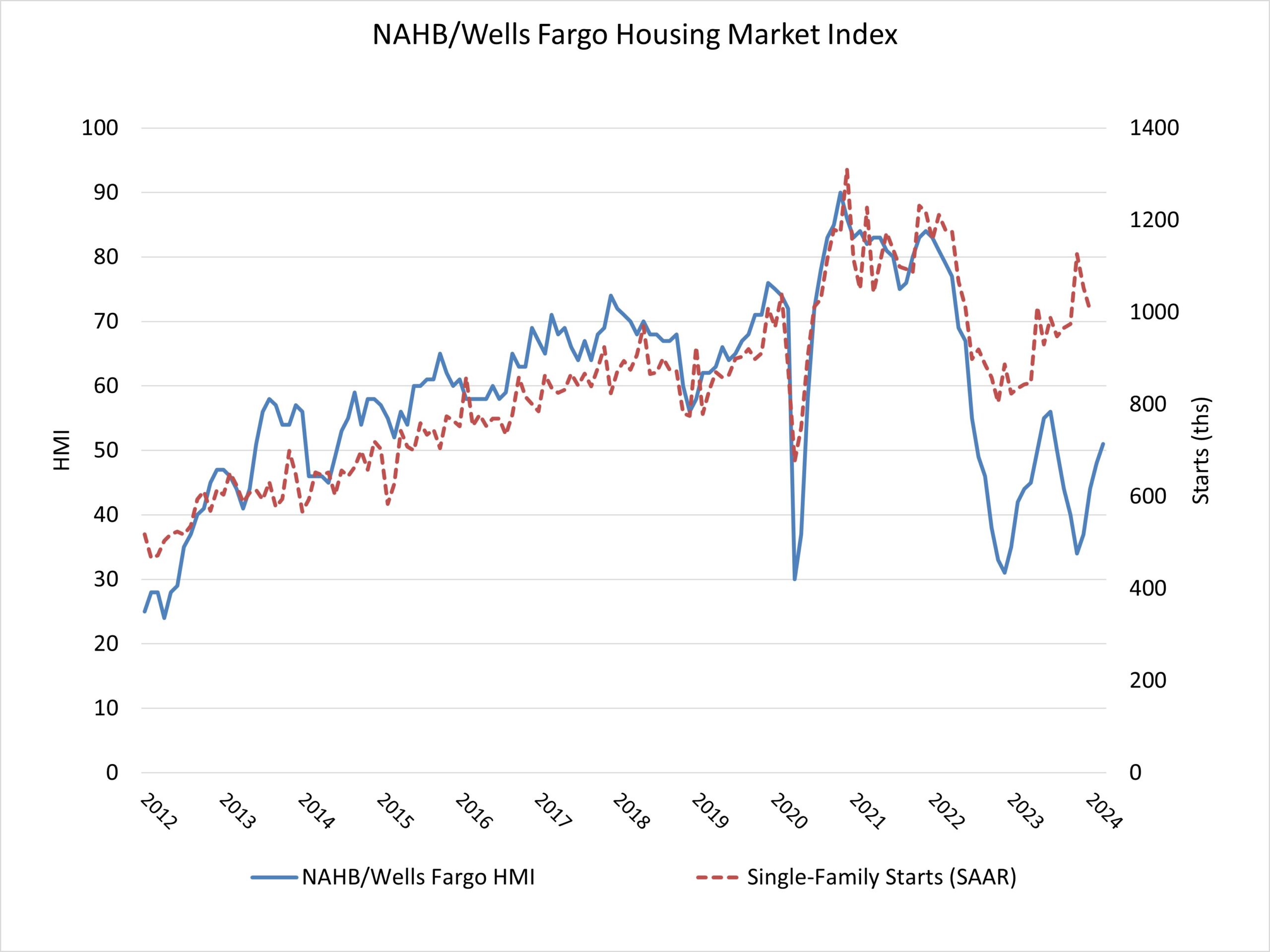

Builder confidence in the market for newly built single-family homes climbed three points to 51 in March, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This is the highest level since July 2023 and marks the fourth consecutive monthly gain for the index. It is also the first time that the sentiment level has surpassed the breakeven point of 50 since last July.

Buyer demand remains brisk and we expect more consumers to jump off the sidelines and into the marketplace if mortgage rates continue to fall later this year, particular as the Fed is expected to enact rate cuts during the second half of 2024. However, builders continue to face several supply-side challenges, including a scarcity of buildable lots and skilled labor, and new restrictive codes that continue to increase the cost of building homes. Building materials will also face upward pressure on prices as home building activity expands

With mortgage rates below 7% since mid-December per Freddie Mac, more builders are cutting back on reducing home prices to boost sales. In March, 24% of builders reported cutting home prices, down from 36% in December 2023 and the lowest share since July 2023. However, the average price reduction in March held steady at 6% for the ninth straight month. Meanwhile, the use of sales incentives is holding firm. The share of builders offering some form of incentive in March was 60%, and this has remained between 58% and 62% since last September.

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three of the major HMI indices posted gains in March. The HMI index charting current sales conditions increased four points to 56, the component measuring sales expectations in the next six months rose two points to 62 and the component gauging traffic of prospective buyers increased two points to 34.

Looking at the three-month moving averages for regional HMI scores, the Northeast increased two points to 59, the Midwest gained five points to 41, the South rose four points to 50 and the West registered a five-point gain to 43.

The HMI tables can be found at nahb.org/hmi

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.

This article highlights the positive shift in builder sentiment, indicating improved confidence in the housing market. For individuals seeking construction loans, this uptick in sentiment suggests favorable conditions for embarking on new construction projects. Lenders offering construction loans should capitalize on this optimism by providing flexible financing solutions to meet the increasing demand, thereby supporting continued growth in the construction sector.