NAHB analysis of Census data shows that private residential construction spending rose 1.1% in November, after an increase of 2% in October. It stood at a seasonally adjusted annual pace of $897 billion. Total private residential construction spending is 3.7% higher compared to a year ago.

The monthly increase for total construction spending is attributed to more co single-family and multifamily construction. Spending on single-family construction rose 2.9% in November. It is consistent with the surge in November of single-family starts, since a lack of existing home inventory is boosting new construction. This is the seventh consecutive monthly increase since April 2023. Compared to a year ago, spending on single-family construction is 5.5% higher. Multifamily construction spending inched 0.1% in November, as a large stock of multifamily housing is under construction. Private residential improvement spending dropped 0.8% in November and is 2% lower compared to a year ago.

Keep in mind that construction spending reports the value of property put-in-place. Per the Census definition: The “value of construction put in place” is a measure of the value of construction installed or erected at the site during a given period. The total value-in-place for a given period is the sum of the value of work done on all projects underway during this period, regardless of when work on each individual project was started or when payment was made to the contractors. For some categories, published estimates represent payments made during a period rather than the value of work done during that period.

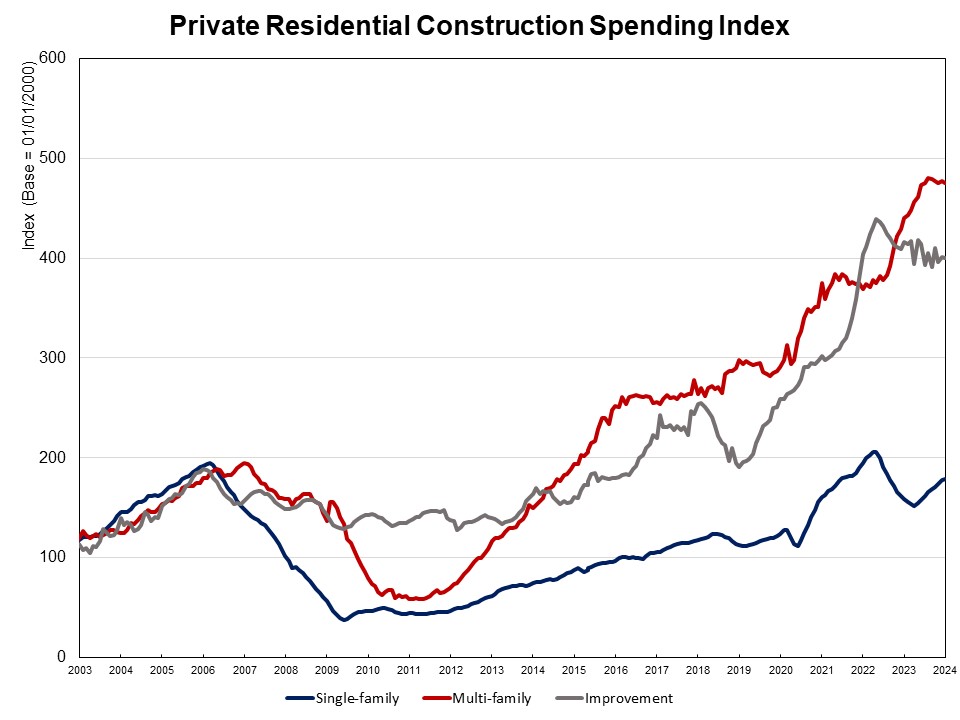

The NAHB construction spending index, which is shown in the graph below (the base is January 2000), illustrates how construction spending on single-family experienced solid growth since May 2023 after a slowdown from early 2022 to April 2023 under the pressure of supply-chain issues and elevated interest rates. Multifamily construction spending growth stayed almost unchanged in the last three months, while improvement spending has slowed since mid-2022.

Spending on private nonresidential construction was up 19.3% over a year ago. The annual private nonresidential spending increase was mainly due to higher spending on manufacturing ($78 billion), followed by the power category ($12 billion).

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.

Encouraging news on private residential construction spending in November! As the sector continues to grow, it underscores the potential for increased demand in construction loans. Lenders and developers should stay attentive to these positive trends for strategic opportunities in the evolving real estate landscape.