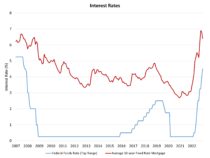

Downshifting its pace of tightening of monetary policy, the Federal Reserve’s monetary policy committee raised the federal funds target rate by 50 basis points, increasing that target to an upper bound of 4.5%. This marked a relatively smaller increase after four previous 75 basis point hikes.

The Fed has clearly communicated it will continue to tighten monetary policy however, raising rates into the first quarter of next year. In fact, the Fed’s projections indicate it will likely raise by another 50 to 75 basis points at its next two meetings. Due to recent long-term rate declines, it appears markets have not priced in this future tightening. Moreover, today’s outlook from the Fed takes rates 50 basis points higher than their previous projections from September.

What does this mean for housing? The Fed is likely to continue to raise rates, moving mortgage rates higher than they are today. However, the end of the rate tightening cycle appears now to be in view. That said, the Fed will maintain these newly set elevated rates for the remainder of 2023.

This means that the Fed will not ease policy any time soon. The Fed’s projections suggest rate cuts will not begin until 2024. And while the Fed will likely cut by about 100 basis points in 2024, per its own current projections, the central bank will maintain rates above its estimated neutral rate (2.5%) well into 2025.

The Fed recognizes that these higher rates will inflict additional economic pain. Indeed, the central bank increased its forecast for the unemployment rate. They now see that rate increasing to average 4.6% rate n 2023, up from 4.4% per their September forecast. This is lower than the NAHB forecast, which calls for an average 5.1% rate for 2023.

The outlook for the start of 2023 is choppy, with measurable economic weakness and job losses. And while mortgage rates have retreated in recent weeks due to recession concerns, they are likely to see another up cycle as markets digest the new Fed policy outlook. However, today’s report at least indicates that the Fed is slowing its pace of tightening and with an end in the coming months.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.