Residential construction loan volume reached a post-Great Recession high during the first quarter of 2022, as home building activity entered a new year with higher interest rates. As the single-family building market slows in 2022, the volume of such loans will likely peak in the coming quarters.

The volume of 1-4 unit residential construction loans made by FDIC-insured institutions increased 5% during the first quarter. The volume of loans increased by $4.6 billion on a quarterly basis. This loan volume expansion placed the total stock of home building construction loans at $92.4 billion, a post-Great Recession high.

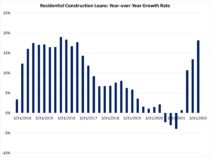

On a year-over-year basis, the stock of residential construction loans is up 18%. Since the first quarter of 2013, the stock of outstanding home building construction loans has grown by 127%, an increase of almost $52 billion.

It is worth noting the FDIC data represent only the stock of loans, not changes in the underlying flows, so it is an imperfect data source. Lending remains much reduced from years past. The current amount of existing residential AD&C loans now stands 55% lower than the peak level of residential construction lending of $204 billion reached during the first quarter of 2008. Alternative sources of financing, including equity partners, have supplemented this capital market in recent years.

The FDIC data reveal that the total decline from peak lending for home building construction loans continues to exceed that of other AD&C loans (nonresidential, land development, and multifamily). Such forms of AD&C lending are off a smaller 26% from peak lending. For the first quarter, these loans posted a 2.3% increase.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.