Loan limits for mortgages backed by the Federal Housing Administration (FHA) were scheduled to fall in 2014 due to the expiration of increased limits set during the housing crisis. However, the magnitude of change for the published limits has caught many by surprise.

Stimulus legislation established higher limits to ensure homebuyer access to credit during the Great Recession. In general, FHA loan limits are set according to local home prices, subject to certain caps and floors. This legislation raised the cap from the prior level of $625,500 to $729,750. The factor translating local home prices to an applicable limit was also increased from 115% to 125% in high cost areas. A floor of $271,050 is also in place.

As required by the 2008 Housing and Economic Recovery Act of 2008 (HERA), after January 1, 2014 the cap is scheduled to fall back to $625,500 and the 115% factor returns. However, another change concerns the use of the methodology for applying area median home prices. This change results in applying lower prices to determine 2014 loan limits for some counties. The result is an additional reduction in FHA loan limits in many areas including places that experienced steep price declines during the recession. More than 300 counties are set to experience a drop in limits due to this home price methodology change.

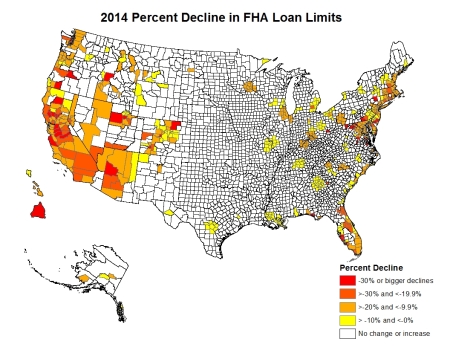

The map below (click for a larger view) summarizes the combined effect of these changes.

NAHB’s analysis indicates that 408 counties will experience a loan limit decrease in excess of 10% as result of both the required cap and factor change and the price data impact. 102 counties will see a drop of more than 30%. The affected areas contain relatively dense concentrations of homes and population. For example, counties seeing a decline in FHA loan limits contain approximately 58% of owner-occupied homes in the nation.

NAHB joined with a number of other housing industry groups, including NAR and MBA, to express concern regarding the new limits.

These groups are urging HUD to provide transparency in showing the methodology used to determine the new loan limits; to not lower the limit in an area beyond the amount due to the change from the temporary to permanent statutory loan limit provisions, or to phase-in reductions that are greater than that magnitude; and, to extend the Jan. 6, 2014 deadline for appeals of the new local area limits to provide additional time to present data to HUD which could result in a reevaluation of loan limits for a particular area.

Chellie Hamecs of NAHB’s Housing Finance Department also contributed to this post.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

4 thoughts on “Published FHA Loan Limits Show Large Declines for 2014”