During the second quarter of 2024, credit for residential Land Acquisition, Development & Construction (AD&C) continued to tighten and became even more expensive for most types of loans, according to NAHB’s survey on AD&C Financing. The survey was conducted in July and asked specifically about financing conditions in the second quarter, predating the release of some relatively weak economic data that has raised prospects for monetary policy easing.

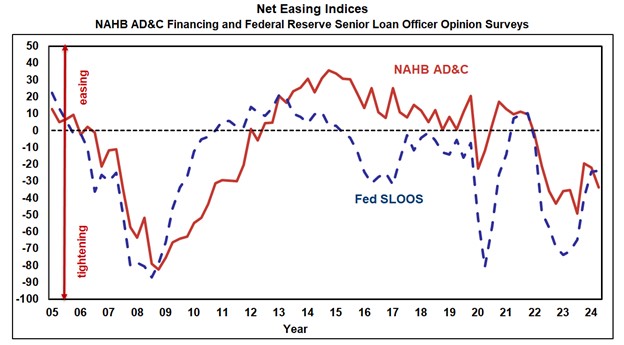

The net easing index derived from the survey posted a reading of -33.7 in the second quarter (the negative number indicating that credit was tighter than in the previous quarter). The comparable net easing index based on the Federal Reserve’s survey of senior loan officers posted a similar result, with a reading of -23.8—marking the tenth consecutive quarter of borrowers and lenders both reporting tightening credit conditions.

According to the NAHB survey, the most common ways in which lenders tightened in the second quarter were by reducing the amount they are willing to lend, and by lowering the loan-to-value (or loan-to-cost) ratio, each reported by 85% of builders and developers. After those two ways of tightening, three others tied for third place: increasing documentation, increasing the interest rate, and requiring personal guarantees or other collateral unrelated to the project, each reported by exactly half of the borrowers.

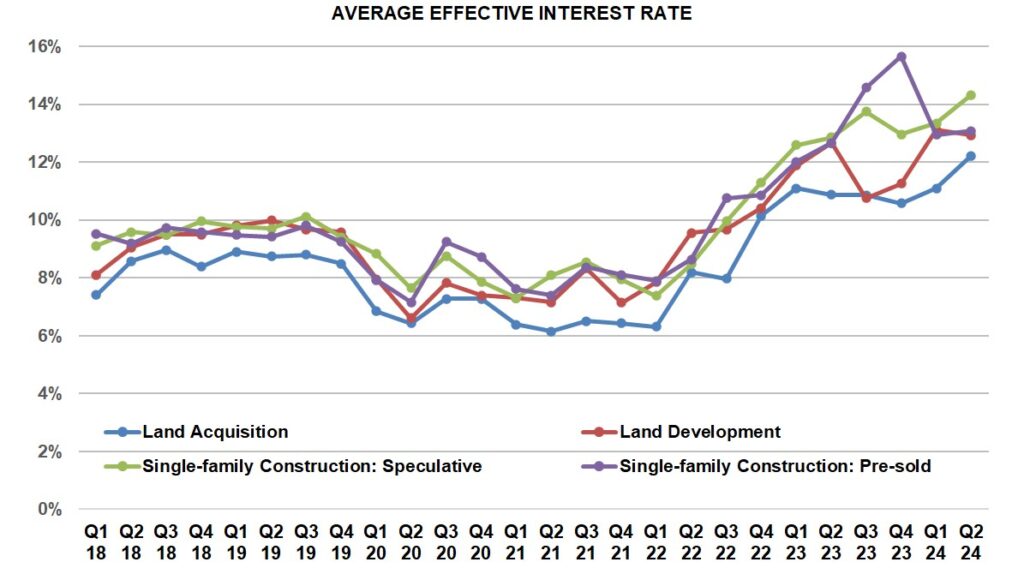

As is often the case, as credit becomes less available it also tends to become more expensive. In the second quarter, the contract interest rate increased on all four categories of AD&C loans tracked in the NAHB survey: from 8.40% in 2024 Q1 to 9.28% on loans for land acquisition, from 8.07% to 9.05% on loans for land development, from 8.24% to 8.98% on loans for speculative single-family construction, and from 8.38% to 8.55% on loans for pre-sold single-family construction.

In addition to the contract rate, initial points charged on the loans can be an important component of the overall cost of credit, especially for loans paid off as quickly as typical single-family construction loans. Trends on average initial points were mixed in the second quarter. The average charge on loans for land acquisition was unchanged at 0.88%. The average declined from 0.85% to 0.70% on loans for land development, and from 0.57% to 0.47% on loans for pre-sold single-family construction. On the other hand, on loans for speculative single-family construction, average initial points increased from 0.76% to 0.89%.

Irrespective of changes in points, increases in the underlying contract rate were sufficient to drive up the average effective interest rate (calculated taking both contract rate and initial points into account), on three of the four categories of AD&C loans in the second quarter. The average effective rate increased from 11.09% to 12.22% on loans for land acquisition, from 13.35% to 14.32% on loans for speculative single-family construction, and from 12.95% to 13.08% on loans for pre-sold single-family construction. Meanwhile, the average effective rate declined on loans for land development—from 13.10% in 2024 Q1 to 12.93%.

The average effective rates on loans for land acquisition and speculative single-family construction in the second quarter of 2024 were the highest they’ve been since NAHB began collecting the information in 2018. However, there’s a reasonable chance the situation will improve in the third and fourth quarters, as the Federal Reserve has begun signaling its intent to cut rates later this year.

More detail on credit conditions for builders and developers is available on NAHB’s AD&C Financing Survey web page.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.