Existing home sales fell for the second straight month in April, after a big monthly drop in March, according to the National Association of Realtors (NAR). Meanwhile, low resale inventory and strong demand continued to drive up existing home prices, marking the tenth consecutive month of year-over-year median sales price gains. Due to elevated interest rates, homeowners with lower mortgage rates stayed put and have not wanted to trade in for higher rates. This is driving home prices higher and resale inventory lower. Eventually, mortgage rates are expected to decrease gradually, leading to increased demand (and unlocking lock-in inventory) in the coming quarters. However, that decline is dependent on future inflation reports.

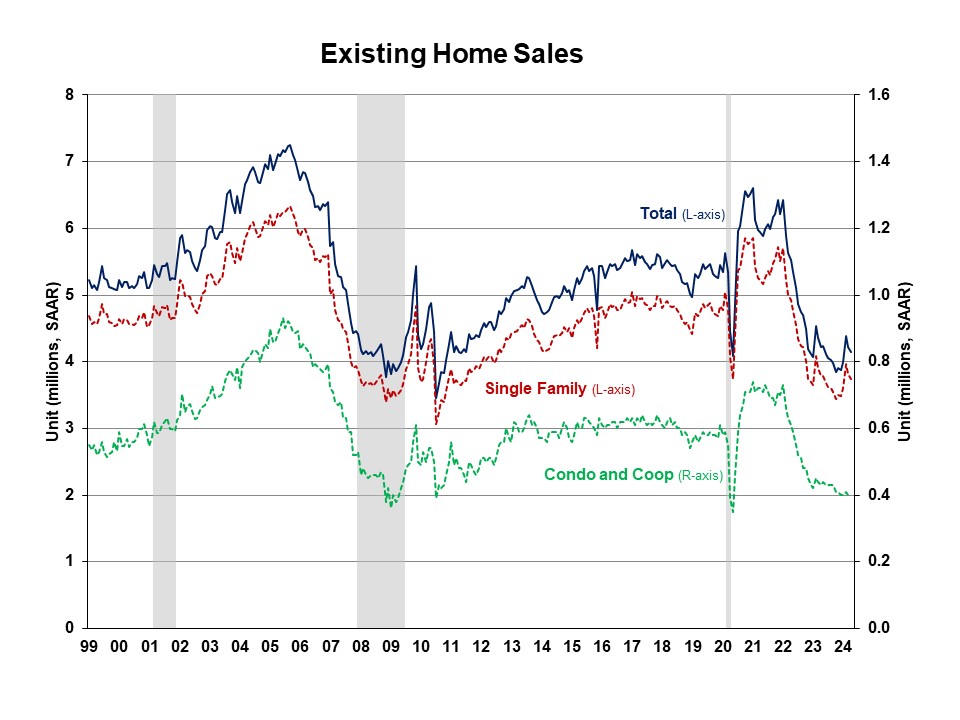

Total existing home sales—including single-family homes, townhomes, condominiums, and co-ops— declined 1.9% to a seasonally adjusted annual rate of 4.14 million in April. On a year-over-year basis, sales were 1.9% lower than a year ago.

The first-time buyer share rose to 33% in April, up from 32% in March and 29% a year ago. Total housing inventory registered at the end of April was 1.21 million units, up 9% from last month and up 16.3% from a year ago.

At the current sales rate, April’s unsold inventory sits at a 3.5-month supply, up from 3.2 months last month and 3.0 months a year ago. This inventory level remains very low compared to balanced market conditions (4.5 to 6 months’ supply) and illustrates the long-run need for more home construction.

Homes stayed on the market for an average of 26 days in April, down from 33 days in March, but up from 22 days in April 2023.

The April all-cash sales share was 28% of transactions, the same share as last month and a year ago. All-cash buyers are less affected by changes in interest rates.

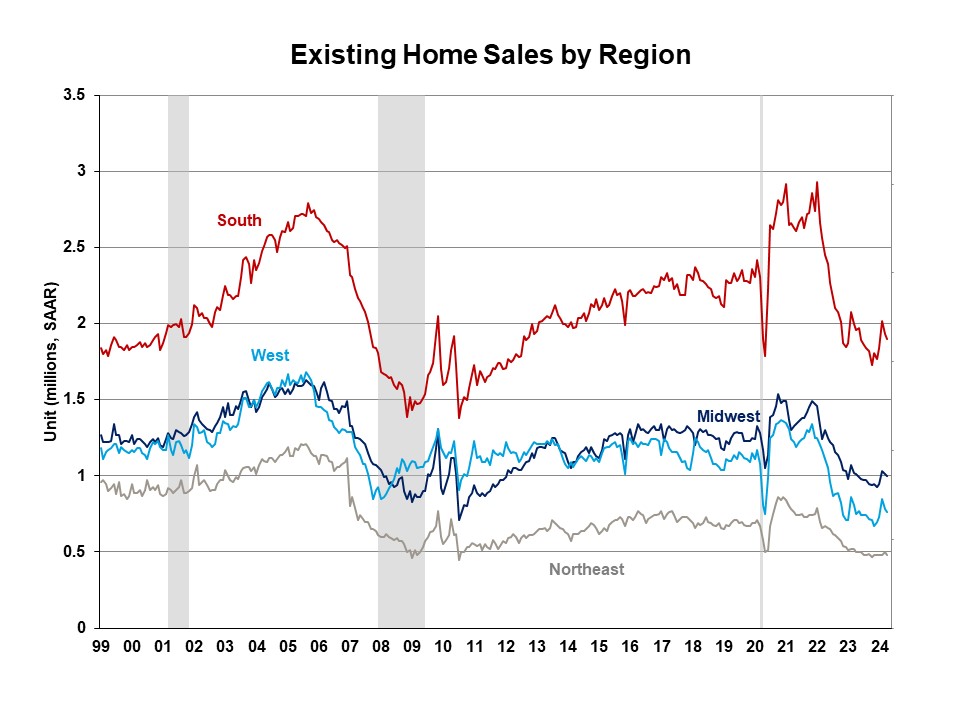

The April median sales price of all existing homes was $407,600, up 5.7% from last year. This marked the highest recorded prices for the month of April. Compared to a year ago, the median single-family prices rose 5.6% to $412,100, and the median condominium/co-op prices increased 5.4% to $365,300. Compared to last month, all four regions saw a decline in existing home sales in April. Sales in the Northeast, Midwest, South, and West decreased 4.0%, 1.0%, 1.6% and 2.6%, respectively. On a year-over-year basis, sales in the Northeast, Midwest, and South decreased 4.0%, 1.0%, and 3.1% in April, while sales in the West rose 1.3%.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.