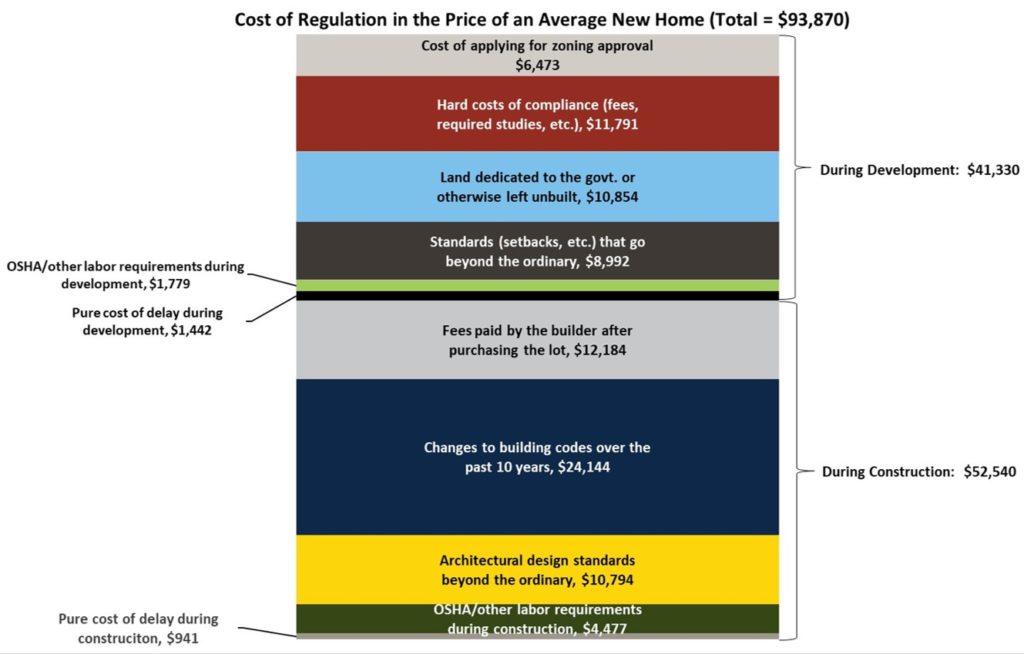

A new NAHB study shows that, on average, regulations imposed by government at all levels account for $93,870 of the final price of a new single-family home built for sale. Of the $93,870, $41,330 is due to a higher price for the finished lot, attributable to regulations imposed during the lot’s development. The remaining $52,540 is the result of regulatory costs imposed on the builder during construction, after the builder purchases the finished lot.

The individual line items in the table range from under $1,000 per home for the pure cost of delay during the construction phase of the project, to more than $24,000 for changes in building codes over the past 10 years.

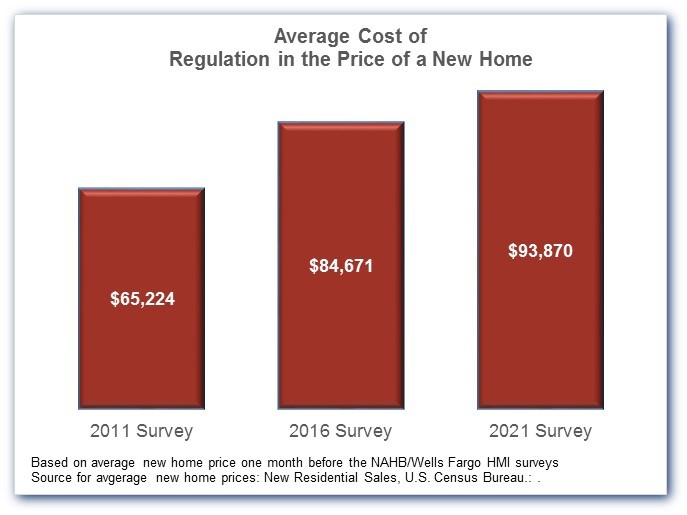

Over time, the NAHB studies show that the cost of regulation continued to climb between 2016 and 2021, although not as fast as it did between 2011 and 2016. The current estimate of $93,870 is up 11 percent from the $84,671 in the 2016 study, and 44 percent from NAHB’s 2011 estimate of $65,224.

The estimate of $41,330 in regulatory costs incurred during development is based largely on the “Land Developer Survey on Regulatory Costs” conducted by NAHB in March of 2021. The $52,540 estimate of regulatory costs during the construction phase is based largely on questions in the March 2021 survey for the NAHB/Wells Fargo Housing Market Index (HMI). Data from the two surveys were combined with information on average construction times, interest rates, profit margins etc. to produce estimates of regulatory costs as a percentage—either of the price of a lot purchased by a builder, or of the builder’s narrowly defined cost of construction. The percentages were then converted to dollars using the February 2021 average new home price of 4,300 from the Census Bureau’s New Residential Sales report. For more information on the methodology, including both survey questionnaires and a complete documentation of all other information incorporated into the estimates, please consult the full study.

Regulatory costs are one of several factors, including record increases in lumber prices, and widespread shortages of materials and labor, currently limiting the supply of housing—particularly housing for the entry-level market, where additional inventory is badly needed.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

A good summary. A good start. What about impact fees? Schools. Fire Districtrs. Sewer. Storm. Water. In some parts of the US such fees could double the $94k referenced above!

Impact fees are included above in either the $11,791 or $12,184 depending on when they are charged and who pays them. Most details like this are relatively easy to see if you click on the link & read the full article.

Agreed, our hook ups / tap fees to our local water/sewer is $23,000 before you ever turn on the water. That is a HUGE chunk out of ones percentage to build a home in our area. Couple that with tight regulations on zoning and it is less expensive to build outside of the city limits and where public water/sewer is available and to build with a well and septic in a township with less stringent regulations and zoning laws.

How many states have a system where construction has to have a certain number of “energy credits” that add to the cost of a home?

Very impressive, thanks a lot for sharing a helpful post with us.