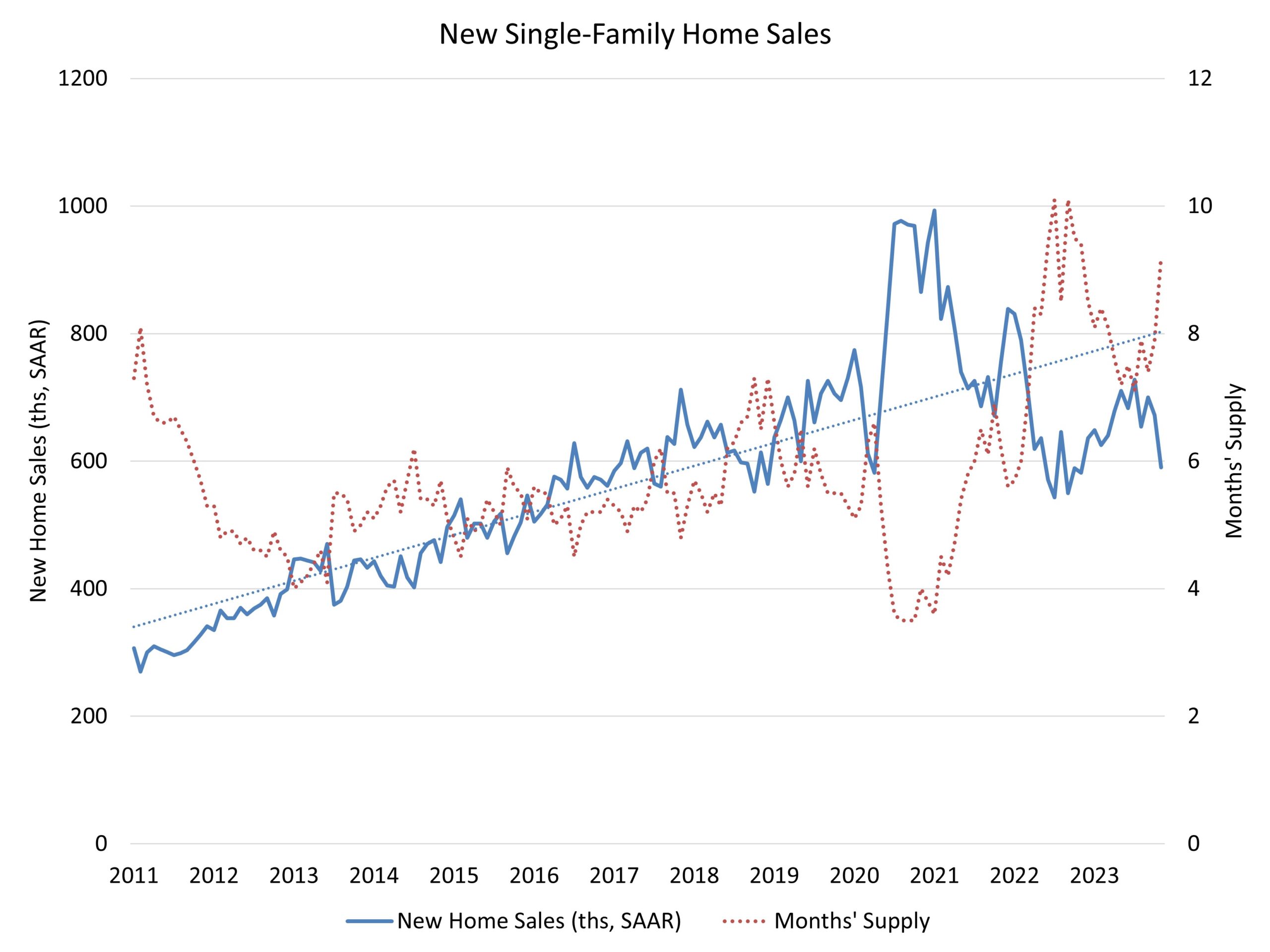

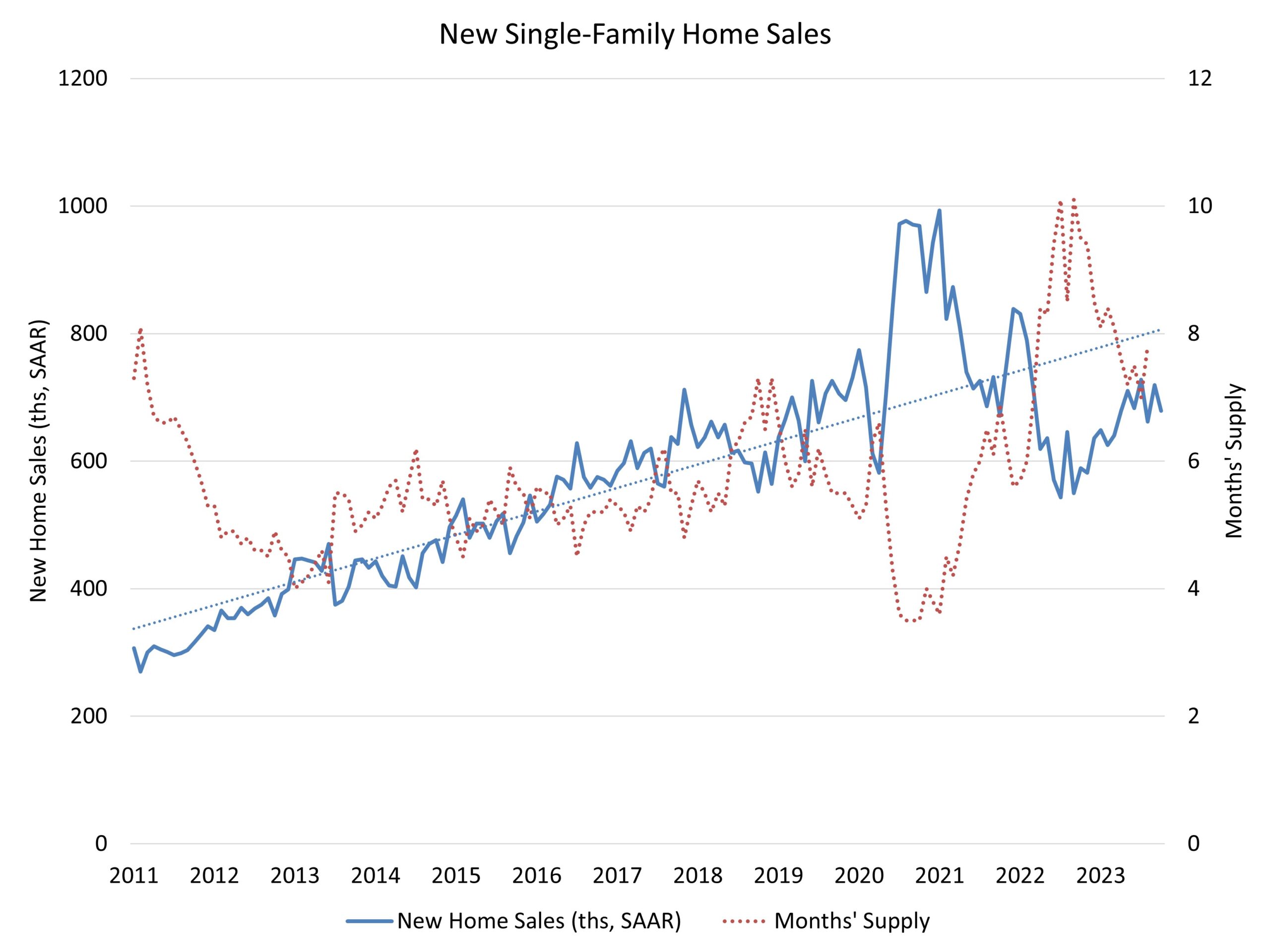

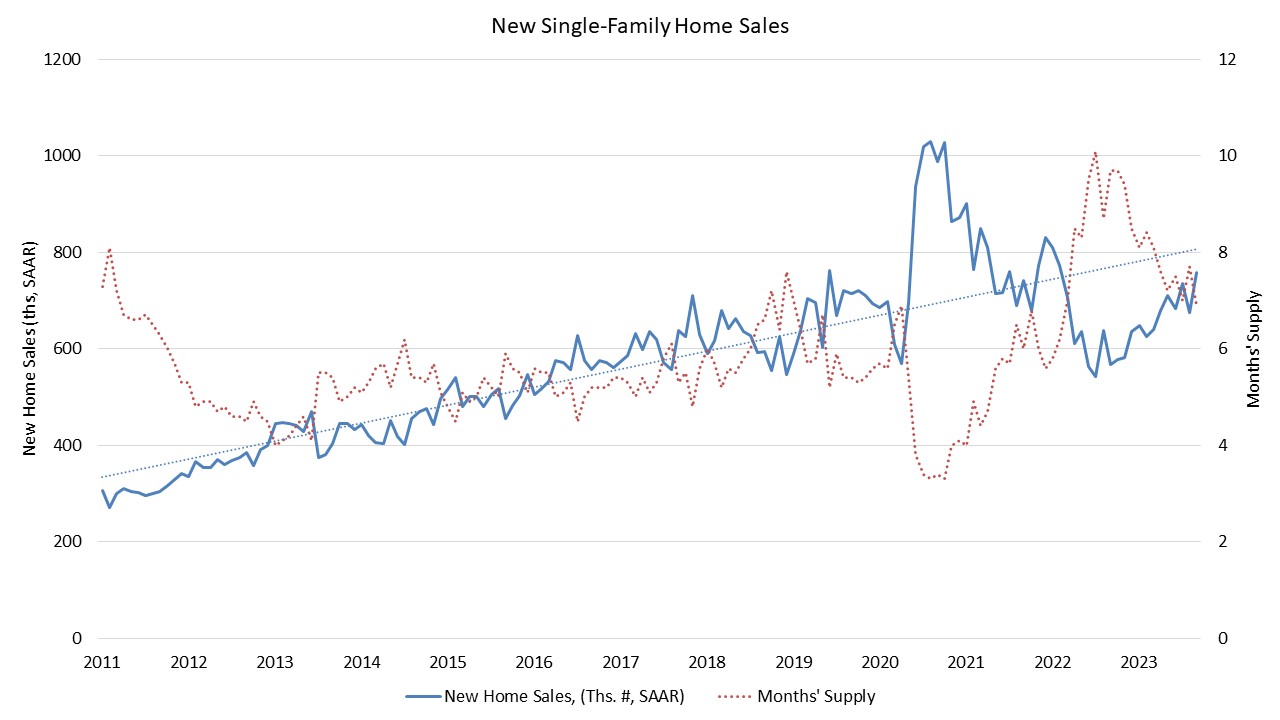

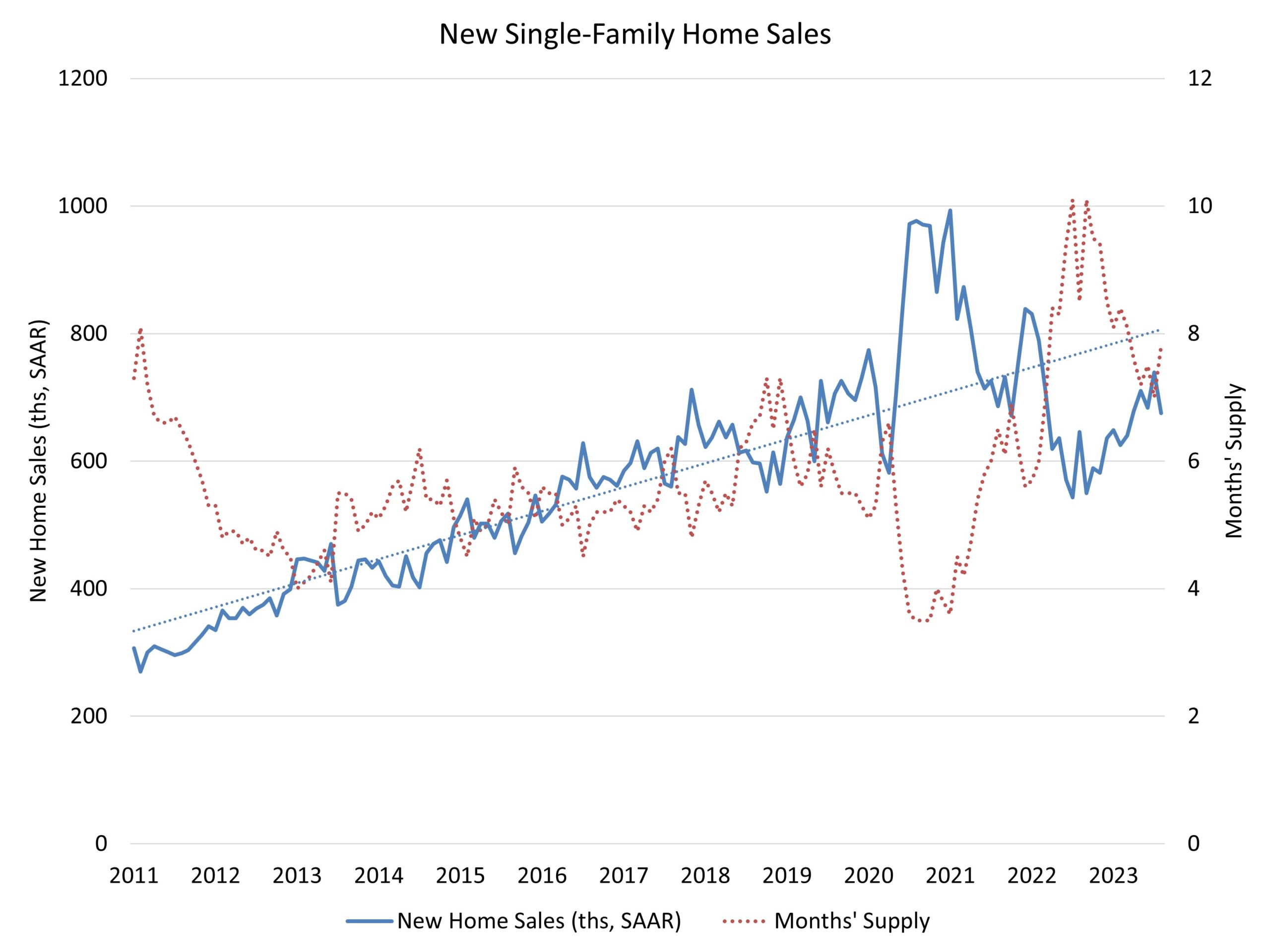

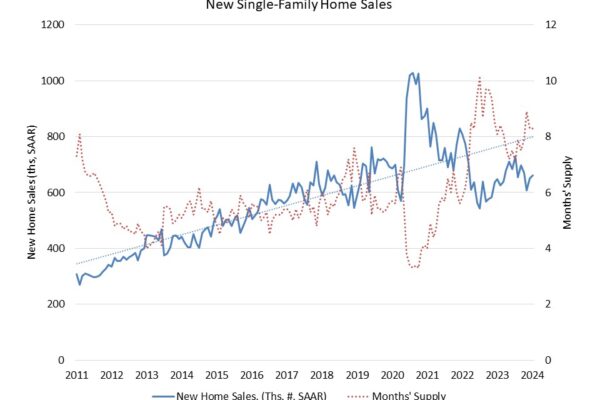

New Home Sales Up at the Start of 2024

Stable mortgage rates at the beginning of 2024 helped new home sales to increase in January. Sales of newly built, single-family homes in January increased 1.5% to a 661,000 seasonally adjusted annual rate from a downwardly revised reading in December, according to newly released data…