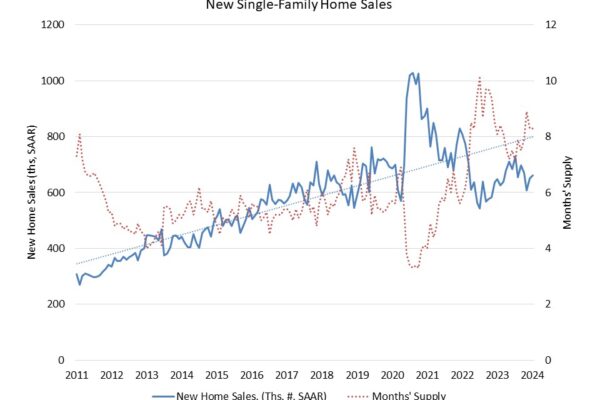

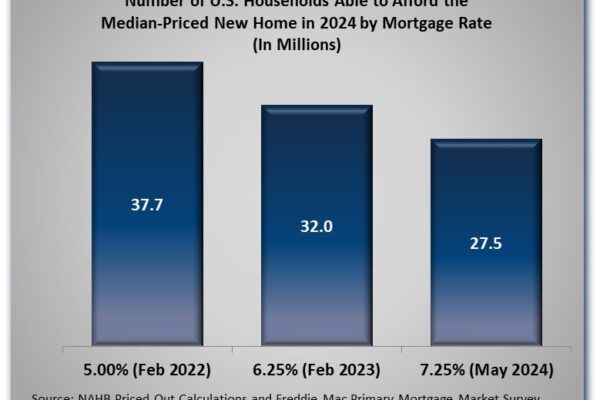

At 2022 Rates, 10 Million More Households Could Afford a New Home

According to the latest press release from Freddie Mac, the average rate on a 30-year fixed-rate mortgage has now risen to approximately 7.25%. As the data posted on NAHB’s priced-out web page shows, at this rate only about 27.5 million (out of a total of…