Home Price Gains Continued in December

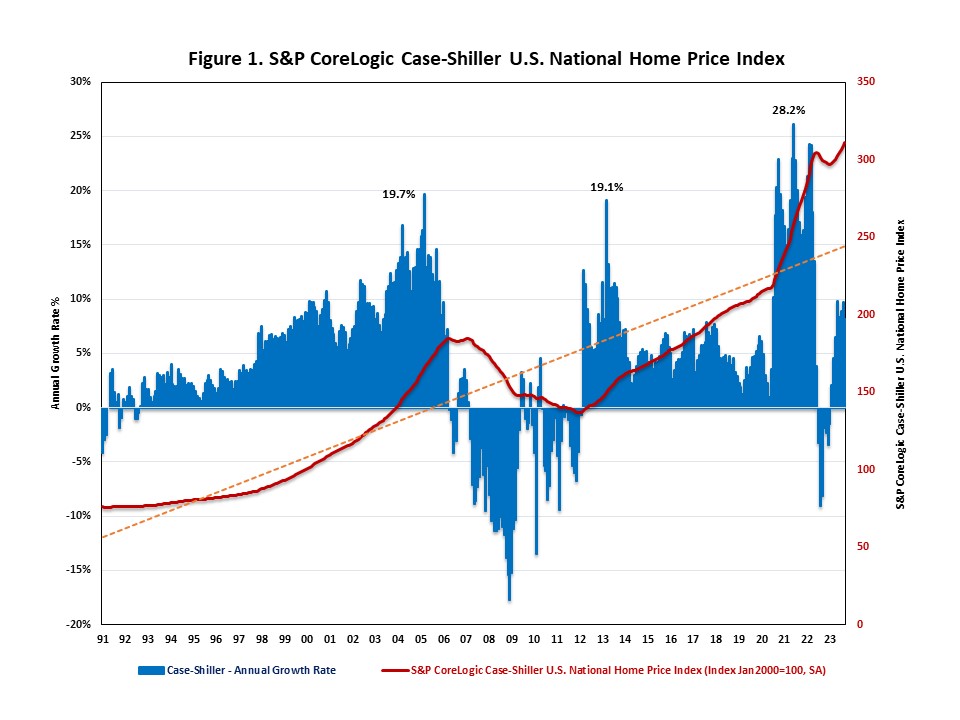

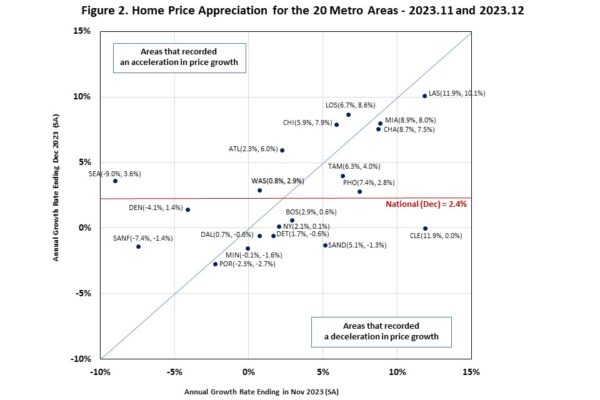

National home prices continued to increase, hitting a new all-time high in December. Despite high mortgage rates, limited inventory and strong demand continued to push up home prices. Locally, six of 20 metro areas, experienced negative home price appreciation in December. The S&P CoreLogic Case-Shiller…