Higher Mortgage Rates Hammer Builder Confidence in May

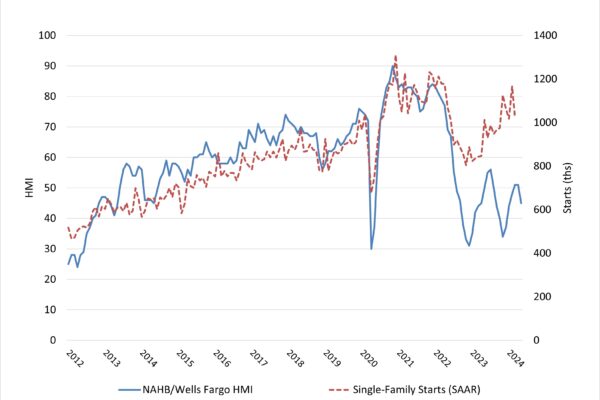

With mortgage rates averaging above 7% for the past four weeks per data from Freddie Mac, builder sentiment posted its first decline since November 2023. Builder confidence in the market for newly built single-family homes was 45 in May, down six points from April, according…