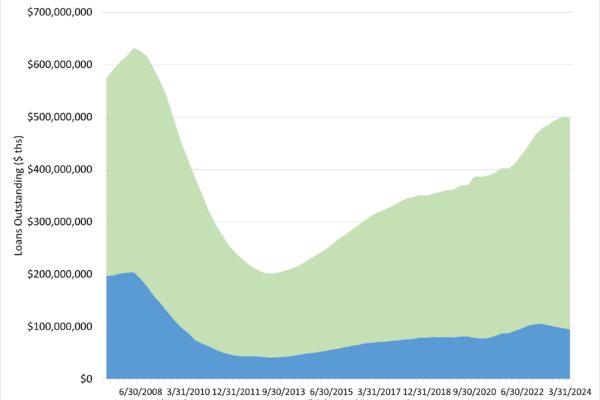

Residential Construction AD&C Lending Declines

The volume of total outstanding acquisition, development and construction (AD&C) loans posted an additional decline during the first quarter of 2024 as interest rates remain elevated and financial conditions are tight. However, AD&C loan conditions will ultimately improve when the Fed begins reducing the federal…