Using the Consumer Expenditure Survey (CES) data from the Bureau of Labor Statistics (BLS), NAHB Economics estimates that a home purchase triggers significant spending on appliances, furnishings, and remodeling. NAHB’s most recent estimates are based on the pre-pandemic 2017-2019 data and show that during the first year after closing on the house, a typical buyer of a newly-built single-family detached home spends on average $9,250 more than a similar non-moving home owner. Likewise, a buyer of an existing single-family detached home tends to spend over $5,240 more than a similar non-moving home owner, as a result of a home purchase.

The NAHB analysis compares spending behavior among three groups of single-family detached home owners: buyers of new homes, buyers of existing homes and non-moving owners. Home buyers, and new home buyers in particular, tend to be larger households with children, and on average wealthier, with higher levels of education and concentrated in urban areas. Any of these factors could potentially explain higher spending on appliances, furnishings and remodeling by home buyers.

To avoid the effects of socio-economic factors, the NAHB estimates control for the impact of household characteristics on expenditures, and, nevertheless, show that a home purchase alters the spending behavior of homeowners and that otherwise similar homeowners spend more across all three categories compared to non-moving owners during the first year after moving.

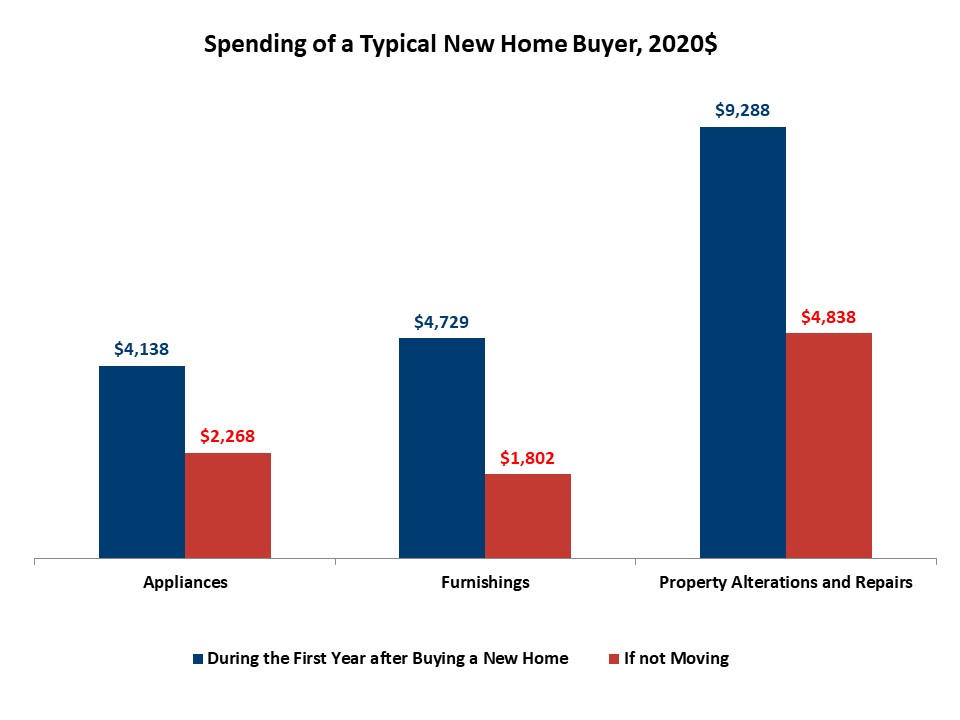

It might come as a surprise but the differences in spending of new home buyers and identical households that do not move are largest on property alterations and repairs. A typical new home buyer that buys a new home is estimated to spend almost twice as much on these projects ($9,288) compared to an identical household that stays put in a house they already own. A closer examination reveals that most of these extra spending is used on building outdoor features, such as patios, pools, walkways, fences, as well as landscaping and various additions to the new house.

In the same way, moving into a new home triggers higher levels of spending on furnishings. A typical new home buyer that moves into a new home is estimated to spend close to $3,000 more on furnishings during the first year compared to a non-moving owner. In the case of appliances, the differences are smallest, but nevertheless, amount to $1,870.

Similarly, buying an older home triggers additional spending. The typical buyer of an existing home is estimated to spend $5,238 more on remodeling, furnishings, and appliances compared to otherwise identical homeowners that do not move. In case of buying an older home, most of this extra spending goes to property repairs, alterations and various remodeling projects. Buyers of existing homes spend close to $7,400 on these projects during the first year after closing on the house; while identical homeowners that do not move spend $4,282. For furnishings, buyers of existing homes boost their spending by over $1,360 during the first year after moving in. In the case of appliances, buyers of existing homes outspend similar non-moving owners by $768.  The statistical analysis further shows that this higher level of spending on furnishings, appliances and property alterations is not paid by cutting spending on other items, such as entertainment, transportations, travel, food at home, restaurants meals, etc. This confirms that home buying indeed generates a wave of additional spending and activity not accounted for in the purchase price of the home alone.

The statistical analysis further shows that this higher level of spending on furnishings, appliances and property alterations is not paid by cutting spending on other items, such as entertainment, transportations, travel, food at home, restaurants meals, etc. This confirms that home buying indeed generates a wave of additional spending and activity not accounted for in the purchase price of the home alone.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.