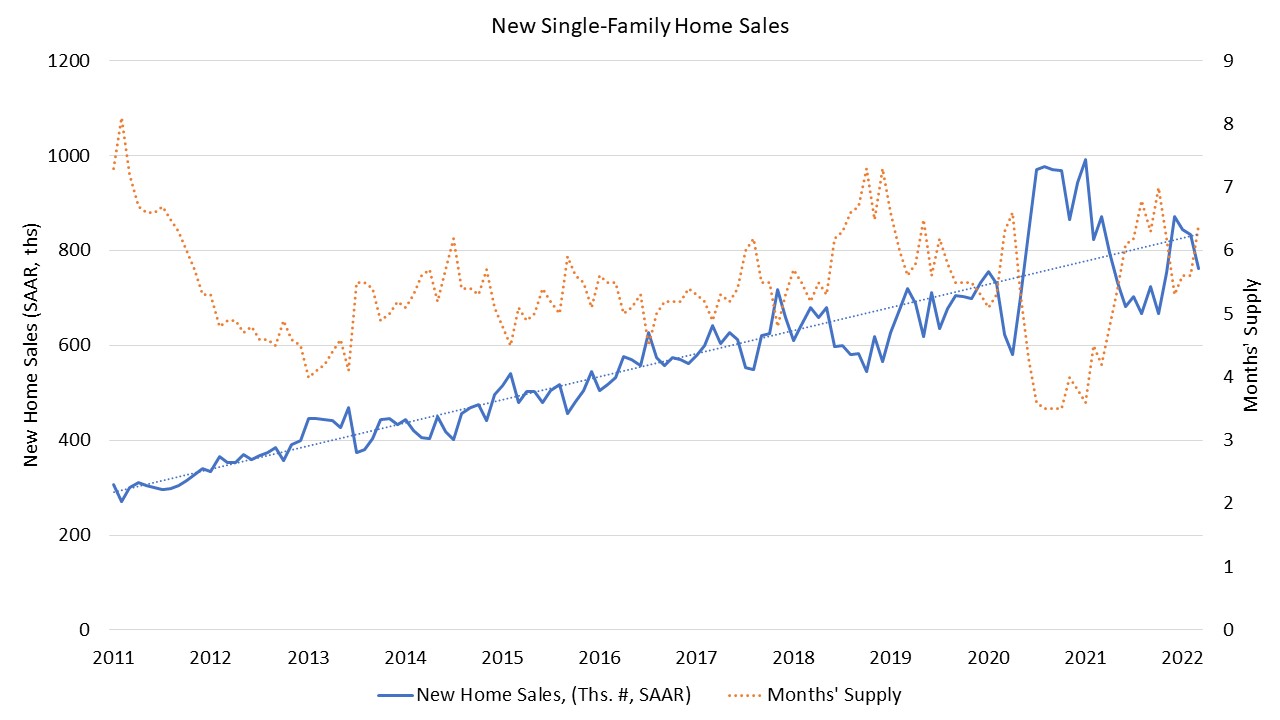

New single-family home sales declined in March as mortgage rates jumped to the highest levels since the start of the pandemic. Per Freddie Mac, the 30-year fixed rate mortgage was 3.89 at the end of February and had climbed to 4.67 at the end of March.

The U.S. Department of Housing and Urban Development and the U.S. Census Bureau estimated sales of newly built, single-family homes in March at a 763,000 seasonally adjusted annual pace, which is a 8.6% decline over upwardly revised February rate of 835,000 and is 12.6% below the March 2021 estimate of 873,000.

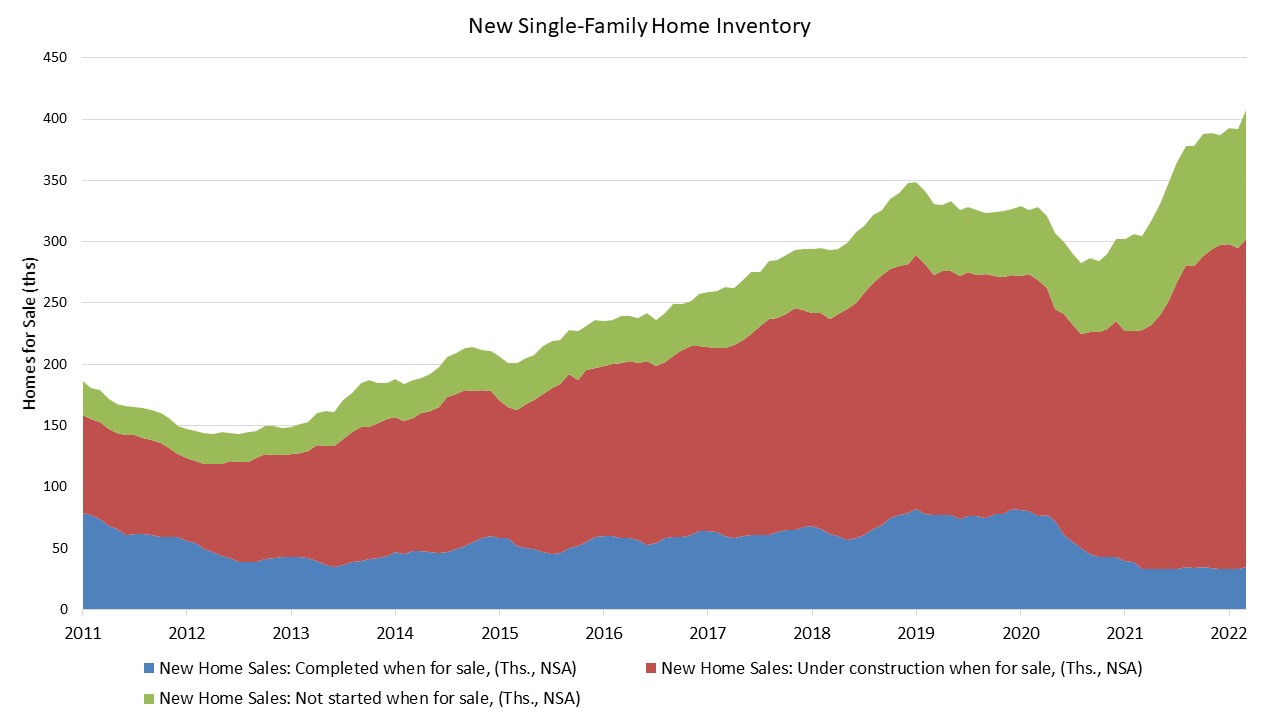

Sales-adjusted inventory levels are at a balanced 6.4 months’ supply in March. The count of completed, ready-to-occupy new homes is just 35,000 homes nationwide. Median sales price is up in March at $436,700 as the cost of residential construction continues to increase in 2022. The median sales price is up 3.6% compared to February and is up 21.4% compared to March 2021.

Moreover, homes available for sale are increasingly allocable to homes that have not started construction, with that count up 35.8% year-over-year, not seasonally adjusted (NSA).

Nationally, on a year-to-date basis, new home sales are down 6.8% for the first quarter of 2022. Regionally, on a year-to-date basis, new home sales were up 10.5% in the Northeast and 8.5% in the West but fell 9.2% in the Midwest and 13.9% in the South.

Discover more from Eye On Housing

Subscribe to get the latest posts sent to your email.

This stat isn’t correct: “sales are increasingly coming from homes that have not started construction, with that count up 35.8% year-over-year, not seasonally adjusted (NSA).” Sales from not started construction (NSA) decreased by 1k compared to March 2021. I believe the 35.8% figure is the increase in the number of homes for sale (inventory) of not started construction, not sold.

Nice catch. That sentence has been corrected. Thanks