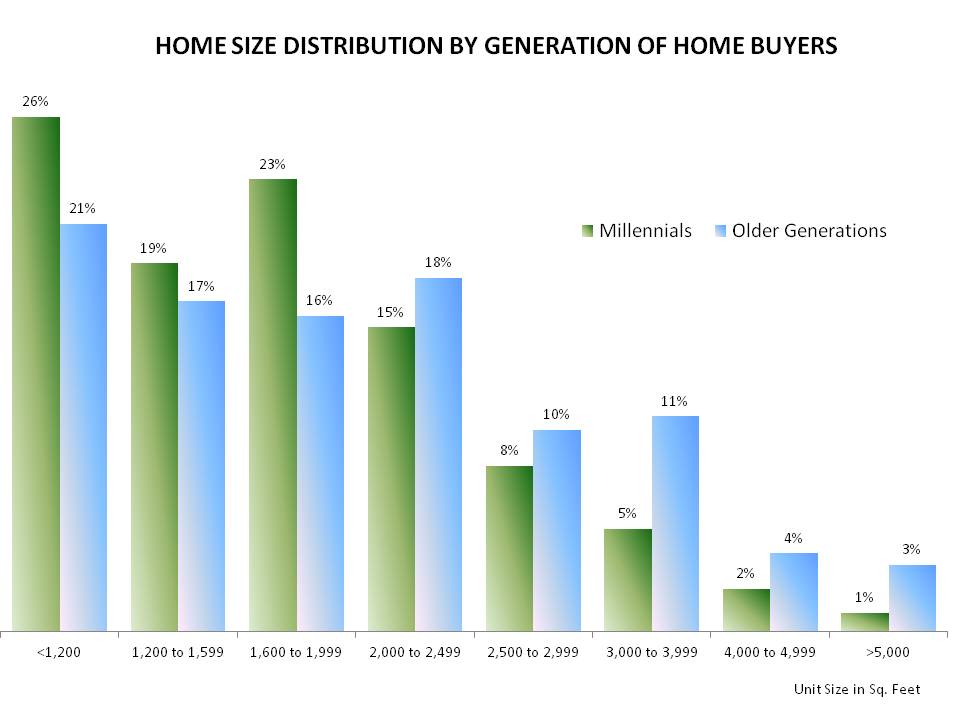

What Homes Do Millennials Buy?

New NAHB research shows that millennials tend to buy homes that are smaller, older, and less expensive than homes bought by older generations. Being the youngest home buyers with little or no accumulated wealth also affects how millennials shop and buy their homes. The majority…