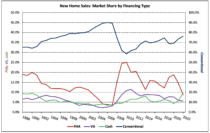

NAHB analysis of the most recent Quarterly Sales by Price and Financing published by the U.S. Census Bureau reveals that cash purchases made 11.2% of new home sales in the fourth quarter of 2022—the largest share since 1990. The share of cash purchases has climbed each of the past four quarters and six of the last seven.

Although the median prices of a new home held firm or increased across other financing types, the median cash price fell from $450,600 to $370,900 in the fourth quarter. On an annual basis, however, home prices climbed higher in 2022 regardless of financing type.

Conventional loans financed 76.1% of new home sales, down 0.2 percentage point over the quarter but still near a 15-year high. The share of VA-backed sales decreased to 5.2% in the fourth quarter and has declined 1.0 ppt since Q2 2022.

The FHA-backed share of new home sales fell to 7.5% in the fourth quarter—a 1.1 percentage point decline (quarter-over-quarter) and 3.0 ppts lower than Q4 2021. Since the second quarter of 2020, the market share of FHA-backed sales has declined by nearly two-thirds.

As conventional loan market share increases, the FHA share typically falls and vice versa. However, this dynamic broke down in 2022 as surging interest rates pushed borrowers to the sidelines and led to an increased share of all-cash sales. Between the first and fourth quarters of 2022, the total share of conventional and FHA-loan new home sales fell 2.6 percentage points while the share of cash sales increased by the same amount.

Although cash sales make up a small portion of new home sales, they constitute a larger share of existing home sales. According to estimates from the National Association of Realtors, 28% of existing home transactions were all-cash sales in December 2022, up from 26.0% in November 2022 and 23.0% in December 2021.

Price by Type of Financing

Different sources of financing also serve distinct market segments, which is revealed in part by the median new home price associated with each. In the fourth quarter, the national median sales price of a new home was $467.700. Split by types of financing, the median prices of new homes financed with conventional loans, FHA loans, VA loans, and cash were $531,400, $330,200, $498,200, and $370,900, respectively.

Between 2020 and 2022, the median price of a new home increased 35.0%–nearly five times the average two-year change dating back to 1990. The price of homes bought with FHA loans rose the most over that period (+37.9%), while the median price of a home purchased using a VA loan increased the least (+24.8%).

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.

This is because empty nesters are cashing out and purchasing smaller homes with the proceeds.

That has always been the case though.

This is such an exciting development in the real estate market! The fact that the market share of all-cash new home sales has reached a 32-year high shows how strong and competitive the housing sector is right now. It’s interesting to see how cash buyers are impacting the industry and what it means for traditional financing options. As a potential homebuyer, I’m curious to learn more about the reasons behind this surge in all-cash transactions and how it might affect the overall housing landscape in the future. Great article, thanks for sharing!

This information is highly enlightening, providing crucial insights into the relationship between financing, sales trends, and home prices in the housing market. The analysis of conventional loan market share, FHA share, and cash sales dynamics, along with the breakdown of median home prices by financing type, paints a comprehensive picture of recent market shifts. These insights are undeniably helpful for anyone seeking a deeper understanding of the housing market’s complexities and trends.